Trending...

- PODS Local Helps Residents Meet Their 2026 New Year's Resolution

- Long Beach: El Dorado Nature Center to Hold New Year, New Use Recycling Drive

- California: Governor and LA Rises announce new online resource to further help LA fire survivors navigate rebuilding

iQSTEL, Inc. (Stock Symbol: IQST) $IQST Also Signs MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Plus $1 Million Subsidiary Sale with Stock Dividend to Shareholders

CORAL GABLES, Fla. - Californer -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

$340 Million Revenue Forecast for 2025.

Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

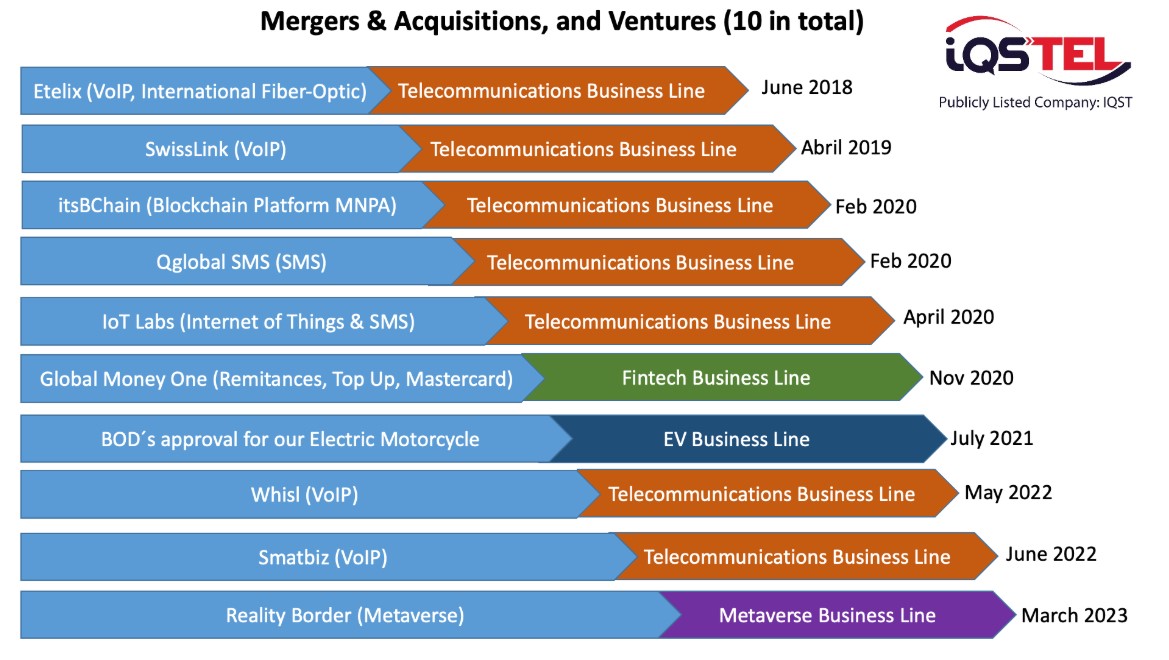

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% YOY Growth and Expanding $79 Million Asset Base.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQST) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQST offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% Year Over Year Growth and Expanding $79 Million Asset Base to Drive Innovation

On March 31st IQST announced its 2024 financial results, highlighting exponential growth, a stronger business foundation, and an expanding vision beyond telecom.

With $283.2 million in revenue, a 95.9% year-over-year increase, and a significant boost in profitability across operating subsidiaries, IQST has not only built a telecom powerhouse but has also been laying the foundation for a diversified, high-tech, high-margin business platform. This platform will fuel expansion into Fintech, AI-driven services, and other cutting-edge technologies, maximizing growth opportunities.

More on The Californer

IQST organic growth, led by Etelix, Swisslink, and IoT Labs—was further accelerated by the transformational QXTEL acquisition, reinforcing its dominance in global telecom while opening new pathways into high-value technology sectors.

Looking ahead into 2025, IQST is committed to debt reduction, cost efficiencies, and strategic acquisitions, targeting a $400 million revenue run rate. With a scalable, high-margin model, IQST is positioned for sustainable long-term expansion, unlocking new revenue streams and shareholder value.

Key Takeaways from the IQST 2024 Financials:

Unprecedented Growth: Revenue increased 95.9% from $144.5 million in FY-2023, to $283.2 million in revenue in FY-2024, nearly doubling in just one year.

Operating Subsidiaries' Adjusted EBITDA: IQST subsidiaries surpassed $2.5 million in Adjusted EBITDA, showing our ability to generate sustainable profits.

Massive Asset Growth: Total assets surged to $79.0 million, up from $22.2 million in 2023, a remarkable 257% increase.

Strengthened Stockholder Equity: Grew 48% to $11.9 million, up from $8.0 million in 2023.

Revenue Per Share: Soared to $1.40 in 2024 vs. $0.84 in 2023, an impressive 66.67% improvement.

In 2025 IQST is set to maximize efficiency, strengthening its financial position, and accelerating transition toward high-margin technology-driven services.

1. Cost Efficiency & Savings Initiatives by implementing a structured cost-saving plan to generate up to $1 million in annual savings while maintaining strong growth momentum.

$500,000 in yearly savings already secured through optimized wage structures.

$300,000 in additional yearly savings starting in Q3 2025, driven by a unified technology platform across subsidiaries.

$200,000 more in yearly savings starting late 2025, through enhanced operational efficiencies.

2. Continued Business Consolidation for Maximum Productivity & Growth. Following the success of Etelix & Swisslink's integration at the operational level, IQST will further streamline telecom operations, optimizing efficiency, reducing costs, and enhancing overall value creation.

3. Debt Reduction Strategy.

IQST plans to complete all QXTEL-related payments in 2025, reinforcing financial flexibility and strategic positioning for continued expansion.

4. Growth Targets for 2025:

Revenue Target: $340 million.

Adjusted EBITDA (operating businesses): Expected to exceed $3 million (excluding new potential acquisitions).

More on The Californer

Globetopper Potential Acquisition

Expected to push revenue toward a $400 million run rate.

Strengthening IQST fintech-driven profitability by expanding high-margin financial technology services.

Transforming the revenue mix to 80% Telecom / 20% Fintech, unlocking higher margins and long-term shareholder value.

5. Additional Strategic Acquisitions for Accelerated Growth

IQST is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with our long-term vision of building a profitable $1 billion revenue company.

6. Expanding High-Tech, High-Margin Offerings Through Global Business Platform

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

By capitalizing on deep industry relationships and existing sales channels, IQST is positioned to seamlessly introduce these new high-margin solutions to its global telecom customer base, further strengthening its role as a leader in technology-driven business transformation.

IQST plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQST broader efforts to enhance shareholder participation and liquidity.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

$340 Million Revenue Forecast for 2025.

Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% YOY Growth and Expanding $79 Million Asset Base.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQST) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQST offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% Year Over Year Growth and Expanding $79 Million Asset Base to Drive Innovation

On March 31st IQST announced its 2024 financial results, highlighting exponential growth, a stronger business foundation, and an expanding vision beyond telecom.

With $283.2 million in revenue, a 95.9% year-over-year increase, and a significant boost in profitability across operating subsidiaries, IQST has not only built a telecom powerhouse but has also been laying the foundation for a diversified, high-tech, high-margin business platform. This platform will fuel expansion into Fintech, AI-driven services, and other cutting-edge technologies, maximizing growth opportunities.

More on The Californer

- Pioneer Executives Brings Holiday Cheer with Toy Donation to Madera Rescue Mission

- Knowledge + Wisdom = Understanding annonces movie Arch of Septimius Severus

- Knowledge + Wisdom = Understanding annonces movie The Desperate Escape

- Knowledge + Wisdom = Understanding annonces movie Aristides 1875 (The Oliver Lewis Story)

- Century Host LLC Expands Nationwide Server Infrastructure for Scalable On Demand Hosting

IQST organic growth, led by Etelix, Swisslink, and IoT Labs—was further accelerated by the transformational QXTEL acquisition, reinforcing its dominance in global telecom while opening new pathways into high-value technology sectors.

Looking ahead into 2025, IQST is committed to debt reduction, cost efficiencies, and strategic acquisitions, targeting a $400 million revenue run rate. With a scalable, high-margin model, IQST is positioned for sustainable long-term expansion, unlocking new revenue streams and shareholder value.

Key Takeaways from the IQST 2024 Financials:

Unprecedented Growth: Revenue increased 95.9% from $144.5 million in FY-2023, to $283.2 million in revenue in FY-2024, nearly doubling in just one year.

Operating Subsidiaries' Adjusted EBITDA: IQST subsidiaries surpassed $2.5 million in Adjusted EBITDA, showing our ability to generate sustainable profits.

Massive Asset Growth: Total assets surged to $79.0 million, up from $22.2 million in 2023, a remarkable 257% increase.

Strengthened Stockholder Equity: Grew 48% to $11.9 million, up from $8.0 million in 2023.

Revenue Per Share: Soared to $1.40 in 2024 vs. $0.84 in 2023, an impressive 66.67% improvement.

In 2025 IQST is set to maximize efficiency, strengthening its financial position, and accelerating transition toward high-margin technology-driven services.

1. Cost Efficiency & Savings Initiatives by implementing a structured cost-saving plan to generate up to $1 million in annual savings while maintaining strong growth momentum.

$500,000 in yearly savings already secured through optimized wage structures.

$300,000 in additional yearly savings starting in Q3 2025, driven by a unified technology platform across subsidiaries.

$200,000 more in yearly savings starting late 2025, through enhanced operational efficiencies.

2. Continued Business Consolidation for Maximum Productivity & Growth. Following the success of Etelix & Swisslink's integration at the operational level, IQST will further streamline telecom operations, optimizing efficiency, reducing costs, and enhancing overall value creation.

3. Debt Reduction Strategy.

IQST plans to complete all QXTEL-related payments in 2025, reinforcing financial flexibility and strategic positioning for continued expansion.

4. Growth Targets for 2025:

Revenue Target: $340 million.

Adjusted EBITDA (operating businesses): Expected to exceed $3 million (excluding new potential acquisitions).

More on The Californer

- RJM Design Group Appointed as Landscape Architecture and Planning Lead for Ontario Sports Empire

- PR Support That Cuts the Mustard for Busy Founders

- OneSolution® Expands to Orlando with New Altamonte Springs Implant Center

- Indian Peaks Veterinary Hospital Launches Updated Dental Services Page for Boulder Pet Owners

- ACIS 2026 "Swing for Sight" Charity Event in Wine Country to Support Ocular Melanoma Research

Globetopper Potential Acquisition

Expected to push revenue toward a $400 million run rate.

Strengthening IQST fintech-driven profitability by expanding high-margin financial technology services.

Transforming the revenue mix to 80% Telecom / 20% Fintech, unlocking higher margins and long-term shareholder value.

5. Additional Strategic Acquisitions for Accelerated Growth

IQST is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with our long-term vision of building a profitable $1 billion revenue company.

6. Expanding High-Tech, High-Margin Offerings Through Global Business Platform

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

By capitalizing on deep industry relationships and existing sales channels, IQST is positioned to seamlessly introduce these new high-margin solutions to its global telecom customer base, further strengthening its role as a leader in technology-driven business transformation.

IQST plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQST broader efforts to enhance shareholder participation and liquidity.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on The Californer

- Car Wash Promo Codes in Northridge CA Are Becoming Obsolete

- Car Wash Coupons in Northridge, CA Are No Longer Necessary

- US Van Rental Expands Group Transportation Services Across Los Angeles

- GIFTAWAY's Wood Wick Candle Collection Sets the Tone for the New Year

- Inclusive Hip-Hop Dance Class with Culture Shock Celebrates Movement Without Limits

- Long Beach: El Dorado Nature Center to Hold New Year, New Use Recycling Drive

- UK Financial Ltd Executes Compliance Tasks Ahead Of First-Ever ERC-3643 Exchange-Traded Token, SMCAT & Sets Date For Online Investor Governance Vote

- "Has Your Book Been Suppressed?" Widespread Censorship by Amazon, Google, and Meta

- TheOneLofi2: New Home for Chill Lo-Fi Hip Hop Beats Launches on YouTube

- Long Beach Health Department Announces Conclusion of Healthy Active Long Beach Program Following Loss of Federal Funding

- Eric Galuppo Highlights Structural Growth Risk Facing Service Companies

- City of Long Beach Invites Public to Share Their Priorities for the 2027 City Budget at Upcoming Community Meetings

- Eric Bellinger Hosts Second Annual Christmas Hoopathon Benefiting Underserved Youth

- ECMG Releases Doom to the World: A Cthulhu Holiday Album (Volume 1)

- California: Governor Newsom proclaims state of emergency to support response in multiple counties due to late December storms

- eJoule Inc Participates in Silicon Dragon CES 2026

- City of Long Beach Issues Rain Advisory Due to Recent Showers

- PODS Local Helps Residents Meet Their 2026 New Year's Resolution

- HBZBZL Unveils "Intelligent Ecosystem" Strategy: Integrating AI Analytics with Web3 Incubation

- Kaltra Launches Next-Gen MCHEdesign With Full Integration Into MCHEselect — Instant Simulation & Seamless Microchannel Coil Workflow