Trending...

- Pacific Harbor Line's Cliatt II Receives Black History Month Trailblazer of the Century Award - 102

- Sellvia Market Enhances Quality Screening for Marketplace Listings

- Transcure Responds to CMS Removal of 285 Inpatient-Only Procedures

Off The Hook YS Inc. (NYSE American: OTH) $OTH is Projected to Reach $140 to $145 Million in 2026 and is Profiled in New BD Deep Research Report on its Position in $57 Billion US Marine Industry

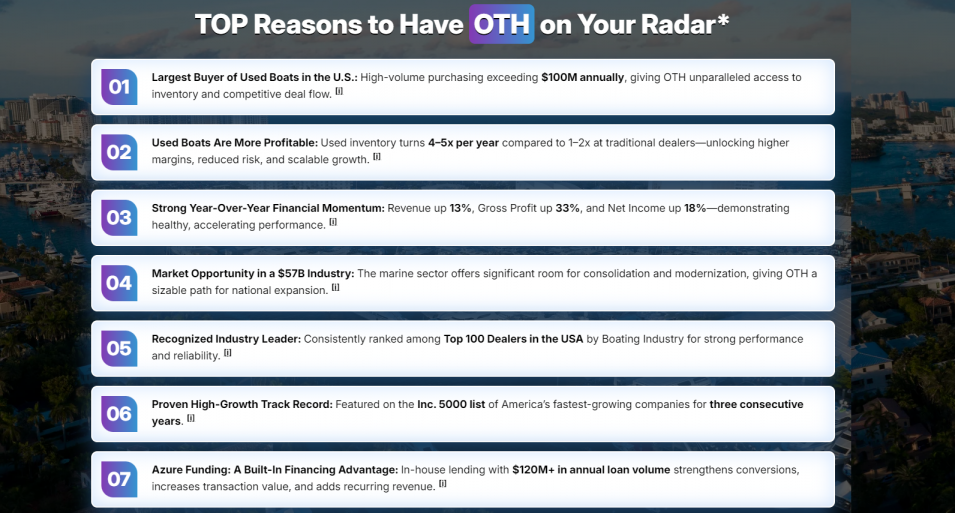

WASHINGTON, N.C. - Californer -- Off The Hook YS Inc. (NYSE American: OTH) is quietly transforming the fragmented pre-owned boat market into a data-driven, institutional-grade platform—and investors are beginning to take notice.

Following its November IPO, the company reported record nine-month revenue of $82.6 million, up 19.3% year over year, alongside accelerating unit growth, expanding margins, and a powerful demand catalyst stemming from newly reinstated 100% bonus depreciation for qualifying boat purchases.

With 2026 revenue guidance of $140–$145 million, OTH is positioning itself as one of the most compelling small-cap growth stories in the U.S. marine industry.

A Market Leader in a Massive, Underserved Industry

Founded in 2012 by President Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales.

The opportunity is significant. The U.S. marine industry is valued at approximately $57 billion, with continued growth driven by recreation, luxury demand, and business-use vessels. In parallel, the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, highlighting durable long-term tailwinds.

OTH has consistently earned recognition on the Inc. 500 and has been ranked among the Top 100 Boat Dealers in the United States, underscoring its operational credibility and scale.

Technology as a Competitive Moat

What differentiates OTH from traditional boat dealers is its AI-assisted valuation tools and data-driven sales platform, which bring speed, transparency, and liquidity to a historically opaque market.

More on The Californer

By leveraging proprietary data and analytics, OTH accelerates transaction cycles, improves pricing accuracy, and enhances inventory turnover—creating what some analysts describe as a form of structural arbitrage in marine liquidity.

This digital transformation thesis is explored in depth in a newly released BD Deep Investor Research Report, titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

Financial Momentum Continues Post-IPO

On December 15, OTH reported results for the third quarter ended September 30, 2025, marking its first earnings update following its IPO.

Third Quarter 2025 Highlights

Nine-Month 2025 Highlights

Importantly, unit growth continues to outpace revenue growth—an indicator of improving market penetration and long-term operating leverage.

A Powerful Tax Catalyst: 100% Bonus Depreciation

In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying business assets, including boats and yachts, through January 19, 2026.

For eligible buyers using vessels more than 50% for legitimate business purposes, this incentive allows the entire purchase price to be deducted in year one—dramatically improving after-tax economics.

More on The Californer

"This incentive is a game-changer," said Ruegg. "A buyer who meets the IRS requirements can deduct the entire cost of the boat in year one. This has already boosted demand, and we expect interest to surge even further."

As the national leader in pre-owned boat inventory, OTH is uniquely positioned to capitalize on this demand surge, offering one of the broadest all-brand selections in the country—a key advantage over competitors with limited inventories.

Expansion Into Luxury Brokerage

To further strengthen its presence in high-value transactions, OTH recently announced the development of a new Jupiter, Florida office, which will serve as headquarters for Autograph Yacht Group (AYG), its luxury brokerage division led by industry veteran Mike Burke.

The facility includes office space and six on-site boat slips, providing direct inventory access in one of the most active yachting markets in the U.S. The build-out is expected to be completed in early 2026.

Clear Line of Sight to 2026 Growth

Management has issued full-year 2026 revenue guidance of $140–$145 million, reflecting confidence in continued demand, expanding broker productivity, tax-driven buying activity, and platform scalability.

With:

Off The Hook YS Inc. is emerging as a next-generation consolidator and liquidity leader in the U.S. marine market.

Investor Resources

Ticker: NYSE American: OTH

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Following its November IPO, the company reported record nine-month revenue of $82.6 million, up 19.3% year over year, alongside accelerating unit growth, expanding margins, and a powerful demand catalyst stemming from newly reinstated 100% bonus depreciation for qualifying boat purchases.

With 2026 revenue guidance of $140–$145 million, OTH is positioning itself as one of the most compelling small-cap growth stories in the U.S. marine industry.

A Market Leader in a Massive, Underserved Industry

Founded in 2012 by President Jason Ruegg, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales.

The opportunity is significant. The U.S. marine industry is valued at approximately $57 billion, with continued growth driven by recreation, luxury demand, and business-use vessels. In parallel, the U.S. ship repair and maintenance services market, valued at $6.55 billion in 2025, is projected to reach $11.72 billion by 2033, highlighting durable long-term tailwinds.

OTH has consistently earned recognition on the Inc. 500 and has been ranked among the Top 100 Boat Dealers in the United States, underscoring its operational credibility and scale.

Technology as a Competitive Moat

What differentiates OTH from traditional boat dealers is its AI-assisted valuation tools and data-driven sales platform, which bring speed, transparency, and liquidity to a historically opaque market.

More on The Californer

- From Orientation to IEP Meetings: How AI Is Helping Schools Build Stronger Communities

- Arcuri Group Announces Long‑Term Partnership with WakeMed Health & Hospitals to Deliver Situational Awareness and De‑escalation Training

- California: As Trump tears apart decades of environmental progress, Governor Newsom restores nearly 300,000 acres of habitat and cuts average permitting time to 42 days

- New Rock Music Release "Groove Train"

- JiT Home Buyers Announces Standardized Nationwide Operating Model to Strengthen Homeowner Experience

By leveraging proprietary data and analytics, OTH accelerates transaction cycles, improves pricing accuracy, and enhances inventory turnover—creating what some analysts describe as a form of structural arbitrage in marine liquidity.

This digital transformation thesis is explored in depth in a newly released BD Deep Investor Research Report, titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market."

Financial Momentum Continues Post-IPO

On December 15, OTH reported results for the third quarter ended September 30, 2025, marking its first earnings update following its IPO.

Third Quarter 2025 Highlights

- Revenue of $24.0 million

- 112 boats sold, up 51% year over year

- Second-highest quarterly unit volume in company history

- Gross profit of $3.0 million

- Adjusted EBITDA of $0.5 million

- Net loss narrowed to $0.07 million

- Launch of Autograph Yacht Group, a luxury brokerage division

- Addition of 10 new brokers

Nine-Month 2025 Highlights

- Record revenue of $82.6 million, up 19.3%

- 310 boats sold, up 24.4%

- Net income of $0.8 million

- Gross profit of $8.4 million, up $1.5 million year over year

- Adjusted EBITDA of $2.6 million

Importantly, unit growth continues to outpace revenue growth—an indicator of improving market penetration and long-term operating leverage.

A Powerful Tax Catalyst: 100% Bonus Depreciation

In July 2025, the "One Big Beautiful Bill Act" reinstated 100% bonus depreciation for qualifying business assets, including boats and yachts, through January 19, 2026.

For eligible buyers using vessels more than 50% for legitimate business purposes, this incentive allows the entire purchase price to be deducted in year one—dramatically improving after-tax economics.

More on The Californer

- Life Hacks of the Rich and Famous named "Best Self Help Podcast"

- Seth Neblett's Mothership Connected: Focuses on P-Funk's Women as Mothership Celebrates 50 Years

- Passive Appoints Ana Bolčević as Head of Design

- At 25, She Became One of the Youngest AAPI Female Founders to Win One of the World's Most Prestigious Design Awards for a Lamp That Makes You Smile

- Sunnyvale Family and Cosmetic Dentistry Highlights Community Access to Advanced Laser Dentistry

"This incentive is a game-changer," said Ruegg. "A buyer who meets the IRS requirements can deduct the entire cost of the boat in year one. This has already boosted demand, and we expect interest to surge even further."

As the national leader in pre-owned boat inventory, OTH is uniquely positioned to capitalize on this demand surge, offering one of the broadest all-brand selections in the country—a key advantage over competitors with limited inventories.

Expansion Into Luxury Brokerage

To further strengthen its presence in high-value transactions, OTH recently announced the development of a new Jupiter, Florida office, which will serve as headquarters for Autograph Yacht Group (AYG), its luxury brokerage division led by industry veteran Mike Burke.

The facility includes office space and six on-site boat slips, providing direct inventory access in one of the most active yachting markets in the U.S. The build-out is expected to be completed in early 2026.

Clear Line of Sight to 2026 Growth

Management has issued full-year 2026 revenue guidance of $140–$145 million, reflecting confidence in continued demand, expanding broker productivity, tax-driven buying activity, and platform scalability.

With:

- Record revenues

- Rapid unit growth

- A national footprint

- AI-enabled operations

- A rare tax incentive tailwind

- And participation in a multi-decade growth industry

Off The Hook YS Inc. is emerging as a next-generation consolidator and liquidity leader in the U.S. marine market.

Investor Resources

- BD Deep Investor Research Report (Dec. 8, 2025):

Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry

👉 https://www.digitalbdinc.com/report/othdeepresearch12-8-25.pdf - Company Website: www.offthehookyachts.com

- Investor Media: https://compasslivemedia.com/oth/

- Contact: Abigail Lafferty

Email: abigail@pantelidespr.com

Phone: (561) 374-0513

Ticker: NYSE American: OTH

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on The Californer

- Majestic CA Fire & Disaster Safe Haven/VIP Ranch Retreat w/ Extraordinary Water Resources

- A Gift of Books: Local Business Helps Launch Homeless Library in Lancaster

- Purple Heart Recipient Honored by Hall of Fame Son In Viral Tribute Sparking National Conversation on Service Fatherhood, Healing and Legacy

- DRC Restoration, a Subsidiary of Solid Restoration, Restores Two-Story Home

- iPOP Alum Jacob Batalon Stars in Amazon Prime's "The Wrecking Crew"

- iPOP Alum Olivia Holt Stars in "This Is Not a Test"

- Sellvia Market Enhances Quality Screening for Marketplace Listings

- JiT Home Buyers Strengthens Multi-State Presence as Demand for Flexible Home Selling Solutions Grows

- $3,000,000 Jury Verdict in Police Shooting Case

- Fiz Detailing Launches Professional Car Detailing Services in Fresno, CA

- Transcure Responds to CMS Removal of 285 Inpatient-Only Procedures

- LEVL Launches in over 350 Target Stores Across the East Coast

- Amicly Launches as a Safety-First Social App Designed to Help People Build Real, Meaningful Friendships

- Primeindexer Google indexing platform launched by SEO Danmark APS

- Kaltra Introduces New Downward-Spraying Distribution Technology to Boost Microchannel Evaporator Performance

- Talentica Announces Winners of Multi-Agent Hackathon 2026

- Fritz Coleman's Show "Unassisted Residency" Begins Third Year at El Portal Theatre

- The Good Feet Store Celebrates 25 Years

- Out of the Shadows: JRoc Azael Emerges with Definitive New Album 'Súbele El Volumen"

- Alert Long Beach Emergency Notification System Restored on New Secure Platform