Trending...

- Memelinked Social Media powered by cryptocurrency launching July 2026 - 318

- California: Following Kristi Noem's firing, Governor Newsom demands DHS redirect funding from Noem's failed ad campaign to LA recovery

- JiT Home Buyers Discusses Growing Challenges of Vacant Homes Across U.S. Housing Markets

Off The Hook YS Inc. (N Y S E: OTH) $OTH is Projected to Reach $140 to $145 Million in 2026 and is Profiled in New BD Deep Research Report on its Position in $57 Billion US Marine Industry

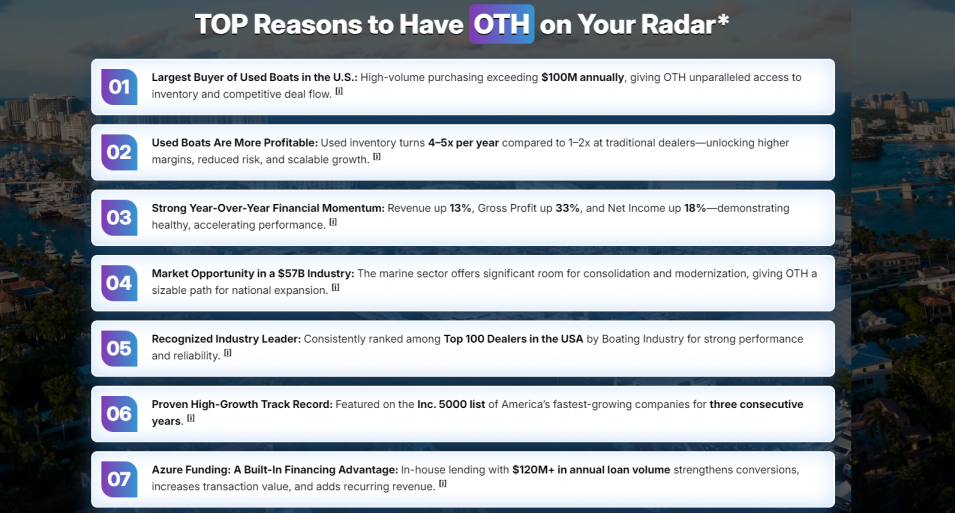

WILMINGTON, N.C. - Californer -- Off The Hook YS Inc. (N Y S E: OTH) is emerging as one of the most compelling under-the-radar growth stories in the U.S. marine industry. Fresh off its 2025 IPO, the Company has authorized a $1 million share repurchase program, launched a high-end luxury yacht brokerage with over $100 million in listings, and delivered record revenues with accelerating unit volume—all while operating in a fragmented, $57 billion domestic marine market ripe for consolidation.

Management's recent actions suggest a clear message to investors: the current market valuation does not reflect the Company's intrinsic value or its forward growth trajectory.

A Scaled Leader in Pre-Owned Boats—Powered by Technology

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, Off The Hook YS has become one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually.

Unlike traditional brokerages, OTH operates a technology-enabled, asset-intelligent platform, leveraging proprietary AI-assisted valuation tools and a data-driven sales engine to bring speed, transparency, and liquidity to marine transactions. This platform advantage allows OTH to efficiently price inventory, accelerate deal velocity, and manage risk across market cycles.

The Company supports this digital infrastructure with a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales—creating a vertically integrated model few competitors can replicate.

Share Repurchase Program Highlights Undervaluation

On January 8, OTH announced authorization to repurchase up to $1.0 million of its common stock, to be funded through cash on hand and future cash flows.

More on The Californer

"Today's stock price and market capitalization do not, in management's view, fully reflect the underlying value of our business, our cash-generation potential, or the long-term opportunity we see ahead," said Brian John, Chief Executive Officer.

The repurchase program underscores management's confidence in the Company's strategy and signals a disciplined capital allocation approach—particularly notable given OTH's early stage as a newly public company with significant growth initiatives underway.

Autograph Yacht Group: A High-Margin Luxury Growth Engine

One of OTH's most intriguing developments is the October 2025 launch of Autograph Yacht Group, its internally created luxury yacht brokerage division.

In just its first quarter of operations, Autograph has:

Autograph operates from waterfront offices in Jupiter and Fort Lauderdale, Florida, placing it squarely in one of the most active luxury boating corridors in the U.S.

What differentiates Autograph is its ability to accept trade-ins, something traditional luxury brokerages typically cannot do. This capability is powered by OTH's proprietary AI platform and wholesale trading operation—creating a structural competitive advantage that improves pricing accuracy, client experience, and transaction velocity.

Financial Momentum and Record Operating Metrics

OTH delivered strong operating performance throughout 2025, highlighted by accelerating unit growth and record revenues.

Nine-Month 2025 Highlights

Q3 2025 Highlights

Importantly, management issued 2026 revenue guidance of $140 million to $145 million, implying a meaningful step-change in scale as Autograph Yacht Group ramps and platform efficiencies compound.

More on The Californer

Structural Tailwinds: Tax Incentives and Industry Growth

The macro backdrop further strengthens OTH's investment thesis.

The "One Big Beautiful Bill Act", signed into law in July 2025, reinstated 100% bonus depreciation for qualifying boats and yachts purchased and placed into service by January 19, 2026. This incentive creates a powerful, time-bound catalyst for business buyers—especially when combined with OTH's national inventory and aggressive pricing.

Meanwhile, the broader marine ecosystem continues to expand:

OTH's scale, data advantage, and national footprint position it well to capture share in both transactional and recurring marine services over time.

Independent Research Coverage Highlights Margin Inflection Opportunity

Adding further credibility, Digital BD Deep Research issued a detailed investor report titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market" (December 8, 2025)

The Bottom Line

Off The Hook YS is no longer just a high-volume boat dealer—it is evolving into a technology-driven marine marketplace with expanding margins, a growing luxury segment, and multiple near-term catalysts. The newly authorized share repurchase program, accelerating luxury brokerage traction, and strong 2026 revenue outlook suggest a company entering its next phase of value creation.

For investors seeking exposure to a differentiated platform within a large, fragmented industry, OTH presents a story that is increasingly difficult to ignore.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Website: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Management's recent actions suggest a clear message to investors: the current market valuation does not reflect the Company's intrinsic value or its forward growth trajectory.

A Scaled Leader in Pre-Owned Boats—Powered by Technology

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, Off The Hook YS has become one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually.

Unlike traditional brokerages, OTH operates a technology-enabled, asset-intelligent platform, leveraging proprietary AI-assisted valuation tools and a data-driven sales engine to bring speed, transparency, and liquidity to marine transactions. This platform advantage allows OTH to efficiently price inventory, accelerate deal velocity, and manage risk across market cycles.

The Company supports this digital infrastructure with a nationwide network of offices and marinas across multiple states, offering brokerage, wholesale, and performance yacht sales—creating a vertically integrated model few competitors can replicate.

Share Repurchase Program Highlights Undervaluation

On January 8, OTH announced authorization to repurchase up to $1.0 million of its common stock, to be funded through cash on hand and future cash flows.

More on The Californer

- Kid's Portal Launches Ad-Free Learning App for Kids Ages 5 to 10

- Sign Up Your Pet, Feed a Family

- RecallSentry™ App Launch — Your Home Safety Hub — Free on iOS & Android

- Award-Winning Director Crystal J. Huang's Under-$50K Film "The Ritual House" Wins Best Horror Feature at Golden State Film Festival

- Grads aren't getting hired — here's what we're doing about it

"Today's stock price and market capitalization do not, in management's view, fully reflect the underlying value of our business, our cash-generation potential, or the long-term opportunity we see ahead," said Brian John, Chief Executive Officer.

The repurchase program underscores management's confidence in the Company's strategy and signals a disciplined capital allocation approach—particularly notable given OTH's early stage as a newly public company with significant growth initiatives underway.

Autograph Yacht Group: A High-Margin Luxury Growth Engine

One of OTH's most intriguing developments is the October 2025 launch of Autograph Yacht Group, its internally created luxury yacht brokerage division.

In just its first quarter of operations, Autograph has:

- Secured over $100 million in active listings

- Closed 22 transactions totaling $35 million

- Built strong momentum in yachts ranging from $500,000 to $20 million+

Autograph operates from waterfront offices in Jupiter and Fort Lauderdale, Florida, placing it squarely in one of the most active luxury boating corridors in the U.S.

What differentiates Autograph is its ability to accept trade-ins, something traditional luxury brokerages typically cannot do. This capability is powered by OTH's proprietary AI platform and wholesale trading operation—creating a structural competitive advantage that improves pricing accuracy, client experience, and transaction velocity.

Financial Momentum and Record Operating Metrics

OTH delivered strong operating performance throughout 2025, highlighted by accelerating unit growth and record revenues.

Nine-Month 2025 Highlights

- Record revenue of $82.6 million, up 19.3% year over year

- 310 boats sold, up 24.4%

- Net income of $0.8 million

- Gross profit of $8.4 million, up $1.5 million year over year

Q3 2025 Highlights

- Revenue of $24.0 million

- 112 boats sold, up 51% year over year

- Second-highest quarterly unit sales in Company history

- Adjusted EBITDA of $0.5 million

Importantly, management issued 2026 revenue guidance of $140 million to $145 million, implying a meaningful step-change in scale as Autograph Yacht Group ramps and platform efficiencies compound.

More on The Californer

- California: Governor Gavin Newsom & Attorney General Bonta: 37 Missing Children Found in Riverside County Operation

- Sovereign Authority Enacts Global Reconstitution; Mobilizes $403.875 Quadrillion Asset Deployment

- California's organized retail crime efforts result in 33,000+ stolen goods recovered in two months

- K2 Integrity Enhances Technology Capabilities Through Acquisition of Leviathan Security Group

- #WeAreGreekWarriors Comes to Detroit in Celebration of Women's History Month

Structural Tailwinds: Tax Incentives and Industry Growth

The macro backdrop further strengthens OTH's investment thesis.

The "One Big Beautiful Bill Act", signed into law in July 2025, reinstated 100% bonus depreciation for qualifying boats and yachts purchased and placed into service by January 19, 2026. This incentive creates a powerful, time-bound catalyst for business buyers—especially when combined with OTH's national inventory and aggressive pricing.

Meanwhile, the broader marine ecosystem continues to expand:

- The U.S. marine industry is valued at $57 billion

- The U.S. ship repair and maintenance services market is projected to grow from $6.55 billion in 2025 to $11.72 billion by 2033, at a 7.52% CAGR

OTH's scale, data advantage, and national footprint position it well to capture share in both transactional and recurring marine services over time.

Independent Research Coverage Highlights Margin Inflection Opportunity

Adding further credibility, Digital BD Deep Research issued a detailed investor report titled:

"Off-The-Hook YS: Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market" (December 8, 2025)

The Bottom Line

Off The Hook YS is no longer just a high-volume boat dealer—it is evolving into a technology-driven marine marketplace with expanding margins, a growing luxury segment, and multiple near-term catalysts. The newly authorized share repurchase program, accelerating luxury brokerage traction, and strong 2026 revenue outlook suggest a company entering its next phase of value creation.

For investors seeking exposure to a differentiated platform within a large, fragmented industry, OTH presents a story that is increasingly difficult to ignore.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Website: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on The Californer

- Matthew Sisneros Releases Raw and Unfiltered Memoir: The Devil Lost Another One — A Powerful Story of Crime, Consequence, and Redemption

- From Life to Light: Jess L. Martinez Shares a Soulful Poetry Collection That Explores What It Means to Be Human

- California: Governor Newsom proclaims Civic Learning Week

- Save the Date! Long Beach Pride Parade Returns May 17

- BrightEdge and ScaleHealth Announce 2026 Cohort Advancing the Next Generation of Cancer Innovation

- Omnigarde Emerges as #2 U.S. Developer for Dual-Iris Accuracy in Global NIST IREX 10 Benchmark

- Lawsuit Filed Against Boeing Over Defective Seat Switch on Boeing 787

- Quadcode Acquires Significant Stake in Game 7, LLC - The Parent Company for FPFX Tech and PropAccount.com

- Cal State LA hosts symposium to prepare students for the future of visual storytelling

- Danholm Collection Announces Sale of 16689 Broadwater Ave in Winter Garden, Highlighting Strong Performance in Twinwaters Community

- GeoArk AI Launches GEO Platform to Help Brands Get Found in AI Search ChatGPT, Claude, Gemini, Grok

- The Southland Symphony Orchestra & Chorus presents "Trouble & Triumph"

- Strong Clinical Results for Breakthrough Liver Diagnostic Platform; ENDRA Life Sciences (N A S D A Q: NDRA) $NDRA

- 46th International Symposium On Forecasting – Dates, Venue And Speakers Announced

- Phoenix Rebellion Therapy Celebrates 10 Years Helping Utahns Overcome Trauma as Utah Faces Nation's 2nd-Highest Rate of Mental Health Challenges

- Oh, What a Beautiful Day- Andrew Polec Sings the Golden Age of Musicals

- New Dumpster Rental Solutions Introduced by Countrywide Rental for the Axis, Alabama University Area

- Two Decades of Strength: Sweat Society Fitness Celebrates 19 Years of Empowering San Diego Women Through Private Coaching

- Bonavita Luxury & Portable Lavatories Announces Rebrand to Bonavita Site Solutions

- New Skin Tattoo Removal and Mass Liberation Announce Grand Opening Collaboration in Los Angeles