Trending...

- California: Three years after the end of Roe, Governor Newsom, First Partner sound the alarm on Trump's "Big, Beautiful" plan to defund Planned Parenthood - 121

- Ascent Solar Technologies Enters Collaborative Agreement Notice with NASA to Advance Development of Thin-Film PV Power Beaming Capabilities: ASTI - 106

- Fact check: Claims swirling on California gas prices

$IQST IQSTEL, Inc. (Stock Symbol: IQST) Forecasts $340 Million Revenue for 2025.

CORAL GABLES, Fla. - Californer -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

$340 Million Revenue Forecast for 2025.

Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

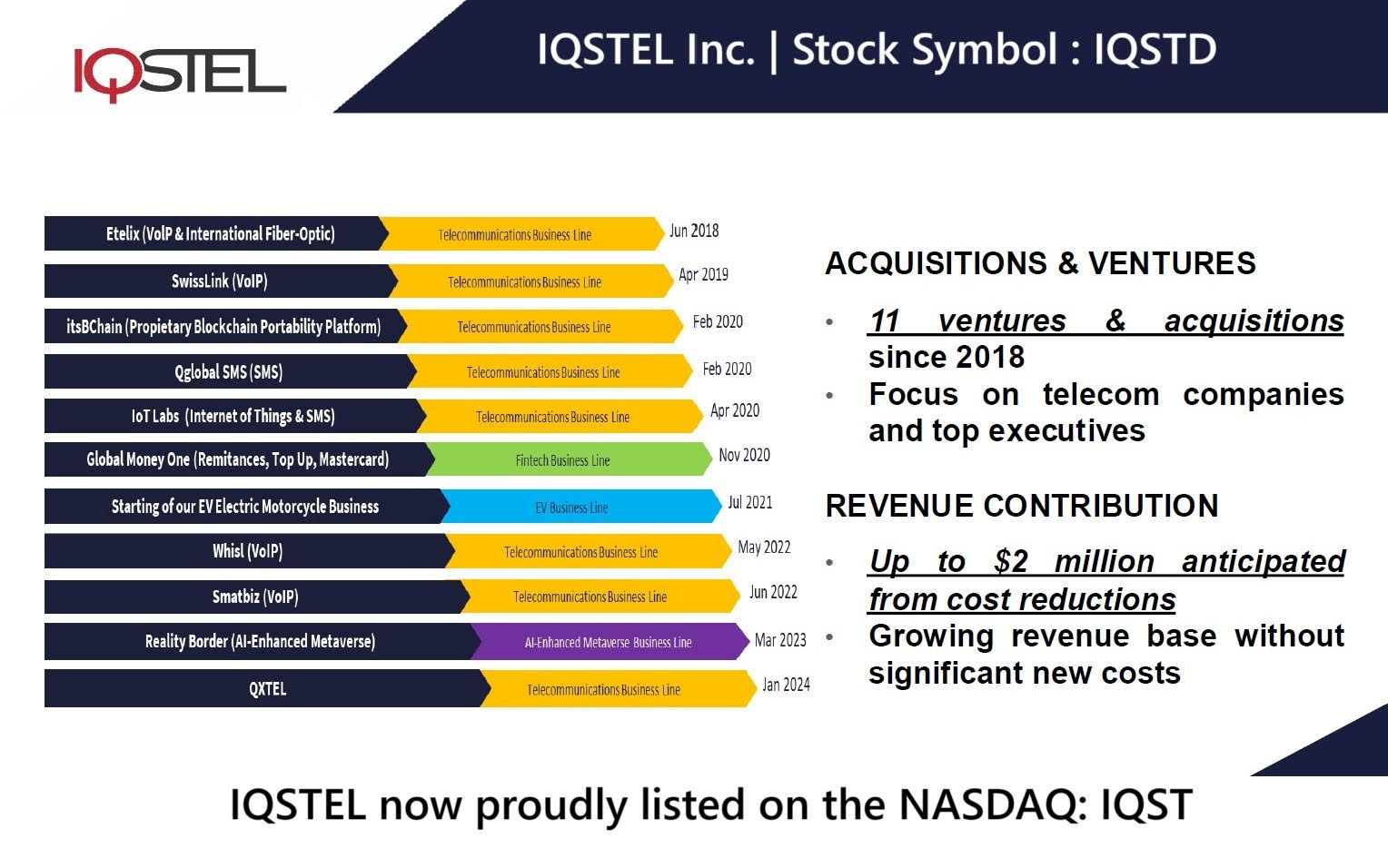

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Accelerating Rollout of Cutting-Edge eSIM and Roaming Connectivity Services.

$57.6M Q1 Revenue Reaffirms Path to $1 Billion by 2027 as Global Tech Evolution Accelerates.

$11.6 Million in Stockholders' Equity or $4.38 Per Common Share.

Successful Uplisting on May 14, 2025 With No Capital Raise or Shareholder Dilution.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. $ASII.

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

IQST Reports $57.6M Q1 Revenue in First Major Market Shareholder Letter, Reaffirms Path to $1 Billion by 2027 as Global Tech Evolution Accelerates

On May 15th IQST released its Q1 2025 Shareholder Letter—its first since being uplisted to the Capital Market. In the letter, CEO Leandro Iglesias detailed the company's performance, strategic vision, and transformation into a high-tech multinational on course to reach $1 billion in annual revenue by 2027.

On May 14th IQST began trading on the Capital Market following seven years of consistent performance and growth on the OTC Markets. This uplisting places $IQST on a global stage with enhanced credibility, visibility, and access to institutional capital.

More on The Californer

Over the past seven years, IQST has consistently delivered on every major commitment to shareholders including:

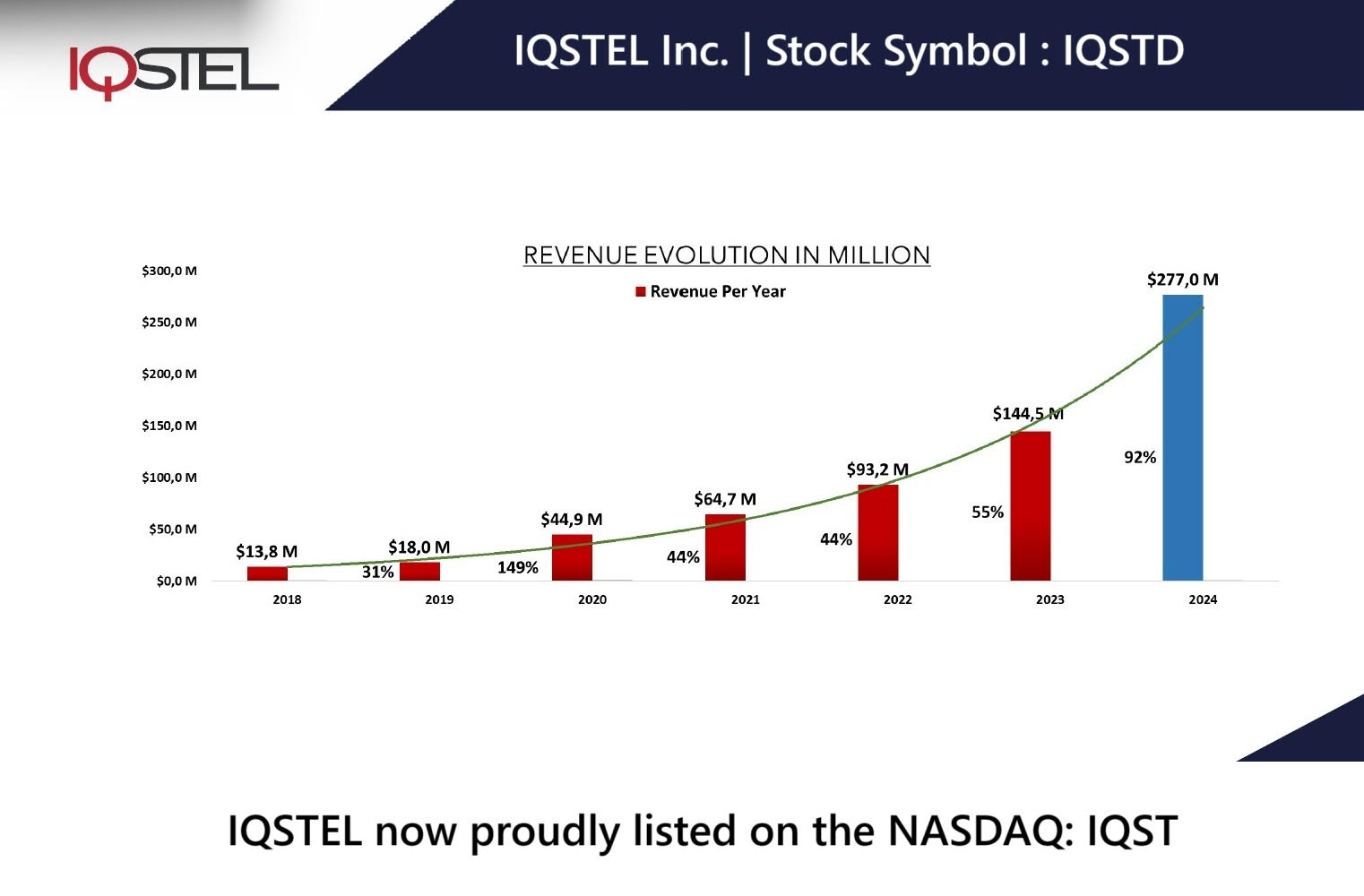

Sustained Revenue Growth: From $13.8 million in 2018 to $283 million in 2024, consistently meeting or exceeding annual forecasts.

Robust Corporate Governance: Fully established Audit, Compensation, and Ethics Committees; an independent Board of Directors; and annual shareholder meetings supporting transparency and accountability.

IQST Uplisting from Pink to QB to OTCQX, culminating in a Big Board Stock listing in 2025—with no capital raise or shareholder dilution.

Enhanced Shareholder Value: Revenue Per Share now exceeds $100, reflecting disciplined growth and execution.

Equity Growth: IQST net stockholders' equity improved from ($1.6 million) or -$0.11 per share in 2018 to $11.6 million or $4.38 per common share as of March 31, 2025—a powerful indicator of the value we've created over time.

Q1 2025: Financial Highlights Reflect a Solid Foundation:

Revenue: $57.6 million (up 12% YoY from $51.4M)

Gross Profit: $1.93 million (up 40% YoY)

Gross Margin: 3.36% (up 2.68% YOY)

Adjusted EBITDA (Telecom Division): $0.59 million

Net Income (Telecom Division): $0.25 million

Stockholders' Equity: $11.6 million or $4.38 per common share

Subsidiary Synergies: $13.4 million revenue between Company subsidiaries

QXTEL Contribution: 37% of revenue, leading in Europe, Middle East & Caribbean

Q4 2024 Revenue Reference: $98.9M, highlighting strong momentum

In 2024, IQST also achieved nearly $100 million in organic growth—a testament to customer trust.

IQST business has now reached critical mass in terms of infrastructure, scale, and market presence. With over 100 employees operating across more than 20 countries, and 600+ business relationships involving direct network interconnections, IQST has built a platform that is both robust and difficult to replicate.

This unique foundation positions IQST to introduce and scale high-margin, high-tech services including:

High Tech Telecom Solutions: eSIM, roaming, and cloud numbering

Fintech Services: digital payments and mobile banking

AI Telecom Services: automation, customer support, lead generation

Cybersecurity Services: enterprise-grade telecom infrastructure protection

The IQST 2025 roadmap is focused on profitable growth, operational scale, and long-term value creation:

FY-2025 Targets Revenue: $340 million: Adjusted EBITDA (Operating Subsidiaries): $3 million+Net Income (Operating Subsidiaries): 7-digitRevenue Run Rate Mix Goal: 80% Telecom / 20% TechYear-End Run Rate: $400 million, with 20% from tech services

More on The Californer

Strategic Acquisitions: Actively pursuing acquisitions in telecom, fintech, and cybersecurity. Focused on targets that contribute positive EBITDA and align with our long-term strategic vision

With its successful uplisting to the NASDAQ Capital Market, IQST has entered a new era—one that is expected to accelerate growth, elevate valuation, and unlock new channels for long-term value creation. Here's what IQST shareholders and investors can anticipate:

IQSTEL Powers Forward: From Global Telecom to High-Tech Innovator with QXTEL Leading New eSIM Rollout

On May 13th IQST announced a bold step forward in its transformation into a high-tech, high-margin global technology corporation. With its international flagship subsidiary QXTEL at the helm, IQST is accelerating the rollout of cutting-edge eSIM and Roaming Connectivity Services, marking the start of a powerful new chapter in the company's evolution.

This transformation began taking shape last week at the International Telecoms Week (ITW 2025) event in Washington, D.C., where QXTEL introduced innovative eSIM & Roaming Connectivity platform solutions in a series of high-level strategic meetings. The response was strong, reaffirming the IQST position as a trusted global player ready to deliver next-generation mobility solutions.

This fully integrated, white-label eSIM and roaming connectivity platform developed by QXTEL's strategic partnership, provides a complete MVNO solution, featuring:

Ownership of IQST IMSI and full network infrastructure.

A comprehensive white-label eSIM & Roaming Connectivity solution that allows MNOs and enterprises to launch their own eSIM/roaming products—quickly, seamlessly, and under their own brand with their own customized commercial modelling.

The ability to negotiate data roaming agreements with 40+ mobile operators, unlocking cost reductions and increased margins.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

$340 Million Revenue Forecast for 2025.

Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Accelerating Rollout of Cutting-Edge eSIM and Roaming Connectivity Services.

$57.6M Q1 Revenue Reaffirms Path to $1 Billion by 2027 as Global Tech Evolution Accelerates.

$11.6 Million in Stockholders' Equity or $4.38 Per Common Share.

Successful Uplisting on May 14, 2025 With No Capital Raise or Shareholder Dilution.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. $ASII.

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

IQST Reports $57.6M Q1 Revenue in First Major Market Shareholder Letter, Reaffirms Path to $1 Billion by 2027 as Global Tech Evolution Accelerates

On May 15th IQST released its Q1 2025 Shareholder Letter—its first since being uplisted to the Capital Market. In the letter, CEO Leandro Iglesias detailed the company's performance, strategic vision, and transformation into a high-tech multinational on course to reach $1 billion in annual revenue by 2027.

On May 14th IQST began trading on the Capital Market following seven years of consistent performance and growth on the OTC Markets. This uplisting places $IQST on a global stage with enhanced credibility, visibility, and access to institutional capital.

More on The Californer

- California: TOMORROW: Make America Rake Again: Governor Newsom to make announcement on new wildfire prevention strategy targeting federal lands

- California: TODAY: Governor Newsom to sign historic bills to create more housing and infrastructure – faster than ever before

- Can This Simple Test Predict How Long You'll Live?

- AI Performs Virtual Tissue Staining at Super-Resolution

- Online Distribution of the Summer 2025 Diamond Certified Directory Update Begins

Over the past seven years, IQST has consistently delivered on every major commitment to shareholders including:

Sustained Revenue Growth: From $13.8 million in 2018 to $283 million in 2024, consistently meeting or exceeding annual forecasts.

Robust Corporate Governance: Fully established Audit, Compensation, and Ethics Committees; an independent Board of Directors; and annual shareholder meetings supporting transparency and accountability.

IQST Uplisting from Pink to QB to OTCQX, culminating in a Big Board Stock listing in 2025—with no capital raise or shareholder dilution.

Enhanced Shareholder Value: Revenue Per Share now exceeds $100, reflecting disciplined growth and execution.

Equity Growth: IQST net stockholders' equity improved from ($1.6 million) or -$0.11 per share in 2018 to $11.6 million or $4.38 per common share as of March 31, 2025—a powerful indicator of the value we've created over time.

Q1 2025: Financial Highlights Reflect a Solid Foundation:

Revenue: $57.6 million (up 12% YoY from $51.4M)

Gross Profit: $1.93 million (up 40% YoY)

Gross Margin: 3.36% (up 2.68% YOY)

Adjusted EBITDA (Telecom Division): $0.59 million

Net Income (Telecom Division): $0.25 million

Stockholders' Equity: $11.6 million or $4.38 per common share

Subsidiary Synergies: $13.4 million revenue between Company subsidiaries

QXTEL Contribution: 37% of revenue, leading in Europe, Middle East & Caribbean

Q4 2024 Revenue Reference: $98.9M, highlighting strong momentum

In 2024, IQST also achieved nearly $100 million in organic growth—a testament to customer trust.

IQST business has now reached critical mass in terms of infrastructure, scale, and market presence. With over 100 employees operating across more than 20 countries, and 600+ business relationships involving direct network interconnections, IQST has built a platform that is both robust and difficult to replicate.

This unique foundation positions IQST to introduce and scale high-margin, high-tech services including:

High Tech Telecom Solutions: eSIM, roaming, and cloud numbering

Fintech Services: digital payments and mobile banking

AI Telecom Services: automation, customer support, lead generation

Cybersecurity Services: enterprise-grade telecom infrastructure protection

The IQST 2025 roadmap is focused on profitable growth, operational scale, and long-term value creation:

FY-2025 Targets Revenue: $340 million: Adjusted EBITDA (Operating Subsidiaries): $3 million+Net Income (Operating Subsidiaries): 7-digitRevenue Run Rate Mix Goal: 80% Telecom / 20% TechYear-End Run Rate: $400 million, with 20% from tech services

More on The Californer

- California: Governor Newsom proclaims Immigrant Heritage Month 2025

- California: Department of Defense agrees: it's time for Trump's militarization of Los Angeles to end

- Long Beach: City Launches Internet Service Enrollment Line

- Von Rock Law Founder Deidre Von Rock Named Super Lawyer for 2025

- California: Governor Newsom extends emergency short-term housing protections in Los Angeles

Strategic Acquisitions: Actively pursuing acquisitions in telecom, fintech, and cybersecurity. Focused on targets that contribute positive EBITDA and align with our long-term strategic vision

With its successful uplisting to the NASDAQ Capital Market, IQST has entered a new era—one that is expected to accelerate growth, elevate valuation, and unlock new channels for long-term value creation. Here's what IQST shareholders and investors can anticipate:

IQSTEL Powers Forward: From Global Telecom to High-Tech Innovator with QXTEL Leading New eSIM Rollout

On May 13th IQST announced a bold step forward in its transformation into a high-tech, high-margin global technology corporation. With its international flagship subsidiary QXTEL at the helm, IQST is accelerating the rollout of cutting-edge eSIM and Roaming Connectivity Services, marking the start of a powerful new chapter in the company's evolution.

This transformation began taking shape last week at the International Telecoms Week (ITW 2025) event in Washington, D.C., where QXTEL introduced innovative eSIM & Roaming Connectivity platform solutions in a series of high-level strategic meetings. The response was strong, reaffirming the IQST position as a trusted global player ready to deliver next-generation mobility solutions.

This fully integrated, white-label eSIM and roaming connectivity platform developed by QXTEL's strategic partnership, provides a complete MVNO solution, featuring:

Ownership of IQST IMSI and full network infrastructure.

A comprehensive white-label eSIM & Roaming Connectivity solution that allows MNOs and enterprises to launch their own eSIM/roaming products—quickly, seamlessly, and under their own brand with their own customized commercial modelling.

The ability to negotiate data roaming agreements with 40+ mobile operators, unlocking cost reductions and increased margins.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on The Californer

- Alten Construction awarded Encinal Junior and Senior High School project

- $796,000 in Q2 Revenue Marks Highest Earnings to Date on 3 Trailing Quarters of Profitability in Multi-Billion Homebuilding Sector: Stock Symbol: IVDN

- Cybersecurity is THE Hot Market Sector; Revenues, Earnings & Profit matter; Only 33 Million Shares + a Huge Short Position Equal an Undervalued Stock

- Despite Global Calls for a Ban, US Child Psychiatry Pushes Electroshock for Kids

- Franco Polished Plaster Celebrates 35 Years of Bringing Walls to Life in the UK

- Spartan & Guardians Partner with Guitar Legend Buckethead to Support Global Child Rescue Efforts

- Preliminary.online Introduces Short-Term Job-Readiness Courses with Employer-Verified Certifications

- Psychologist-Turned-Hermeticist Releases Modern Guide to the Seven Hermetic Principles

- Winners Announced for Asia Pacific Business Awards 2024-2025

- Hamvay-Lang and Lampone.hu Join Forces with AIMarketingugynokseg.hu to Elevate Hungarian Lifestyle Brands on the Global Stage

- Google AI Quietly Corrects the Record on Republic of Aquitaine's Legal Sovereignty

- California: El Gobernador Newsom firma un presupuesto estatal equilibrado que reduce los impuestos a los veteranos, financia completamente las comidas escolares gratuitas, construye más viviendas y crea empleos

- California: Governor Newsom signs balanced state budget that cuts taxes for vets, fully funds free school meals, builds more housing, & creates jobs

- California: Governor Newsom announces appointments 6.27.25

- NYC Leadership Strategist Stacie Selise Launches Groundbreaking 4S Framework Series to Redefine Executive Excellence

- Baby Boomer Housing Trend: Big Homes Out, Simplicity In

- Governor Newsom slams Trump over bill that would cut millions in health coverage, food assistance for California

- Jamison & Tania Events Wins Dual California Wedding Day Magazine "Best of 2025" Awards

- California invests billions of dollars to fix roads with "gas tax," expand bus and train service

- Long Beach: City Offering Space Beach Youth Workforce Summer Camp to Inspire Next Generation of Aerospace Professionals