Trending...

- City of Long Beach Advises Registered Voters of Statewide Special Election This November - 720

- David Oberman Debuts "Americana From Alabama" Project With The Release Of Two New Songs - 119

- Airbnb to Participate in the Goldman Sachs Communacopia + Technology Conference - 108

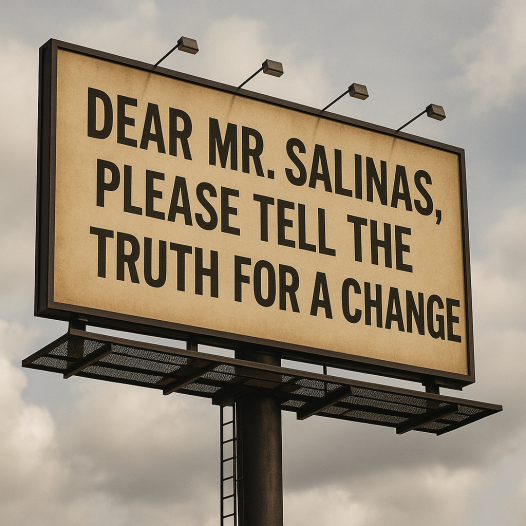

Fiction versus reality. The world must know the truth. Will Ricardo Salinas ever tell the truth?

LONDON - Californer -- NEW YORK — In recent weeks, Ricardo Salinas Pliego has made a series of public claims about his July 28, 2021 loan agreement with Astor Asset Management 3 Ltd ("Astor 3").

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on The Californer

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on The Californer

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on The Californer

- Noatanga Launches Online Platform to Boost Artist Discoverability

- Ace Henderson Join Forces with Championship Division for a Bold New Chapter

- iPOP Alum Ethan Cole Debuts in Peacock Original "The Paper"

- Platinum Plumbing Expands Services, Rebrands as Platinum Plumbing & Water Well Services

- Word Game Peference Test: Would you rather load a dishwasher or soar above a forest? What does Artificial Intelligence think?

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on The Californer

- Voice Of Rainbow Brite, Bettina Bush Debuts First Solo Children's Album "Once Upon A Rainbow"

- Flywire Corporation (FLYW) Investors Who Lost Money Have Opportunity to Lead Securities Fraud Lawsuit

- As Trump administration retreats, California joins forces with Northwest Wildland Fire Fighting Compact

- Hazel-E's Girl Code Inc. Hosts Exclusive Women-Centered Pop-Up Gifting Suite During Emmys Week

- City of Long Beach Awards $220,000 to Level Up Small Businesses

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Source: Astor Asset Management 3 Ltd

0 Comments

Latest on The Californer

- Heritage at South Brunswick Single Family Collection VIP opening soon!

- Hawaii to join West Coast Health Alliance with California, Oregon, and Washington

- AI Musical Artist Kenzy Skye Releases Her Debut Hit Single "Done With You" on YouTube

- California: What they are saying: Leaders throughout the state are applauding Governor Newsom's ongoing strategies to reduce homelessness

- Mount Dora Frida Festival: Feel the Beat, See the Color Sat Sept 27

- Technology veteran Bill Townsend releases shocking new book about AI

- California: Trump's illegal National Guard deployment in Los Angeles cost taxpayers $120 million

- Thinkware Launches All-new Thinkware Connected App

- AutoMobility LA Expands Fleet Innovation Showcase for 2025

- Charleston Hospitality Brings to Light the Advantage of Giving Back as a Growth Strategy

- Intercontinental Real Estate Corp/LaTerra Acquire Santa Clarita, CA Self-Storage Facility for $27 MM

- N/UM Gourmet Salts Launch in Erewhon

- Governor Newsom's Clean California effort reaches major milestone: 3 million+ cubic yards of litter removed, 600+ public art projects installed

- American Friends Service Committee Retains MaGO PR as Agency of Record for First-Ever Hispanic Celebrity PR Campaign: "Immigrants Make Our Communit

- $1.3 Billion Jackpot Fever Highlights Company Reentry to U.S. Lottery Market With Attractive New Rewards Program for AI Powered Entertainment Leader

- First American Geisha vs. Tech Titan: Sprawling & Dunca End Common-Law Marriage in $30M Suit

- Smarter Smiles: Pediatric Orthodontist in San Jose, CA Helping Kids Shine Brighter

- Santa Clara Families Choose Trusted Pediatric Orthodontist for Brighter, Straighter Smiles

- Revenue Optics Expands Leadership Team with Appointment of Pamela Sims as Strategic Marketing Advisor

- "Hustler's Girl Remix" Delivers a Soulful Wake-Up Call to Hustlers Neglecting Love"