Trending...

- AdvisorVault Releases New Explainer Video on their 17a-4 Managed 365 Service

- Psalmist Sylmac Announces Release of "You Reign" – A Powerful New Worship Song

- California: Governor Newsom announces 99.8% compliance with emergency regulations, signs bill to permanently protect children from hemp products

$IQST Institutions are Buying...Why? IQST is Undervalued at $7

CORAL GABLES, Fla. - Californer -- August 2025 — In a marketplace increasingly defined by rapid innovation, IQSTEL, Inc. (N A S D A Q: IQST) is emerging as a rare standout — delivering real revenues, rapid profitability milestones, and strategic diversification across the most exciting sectors in tech: telecom, fintech, electric vehicles, artificial intelligence, and cybersecurity.

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

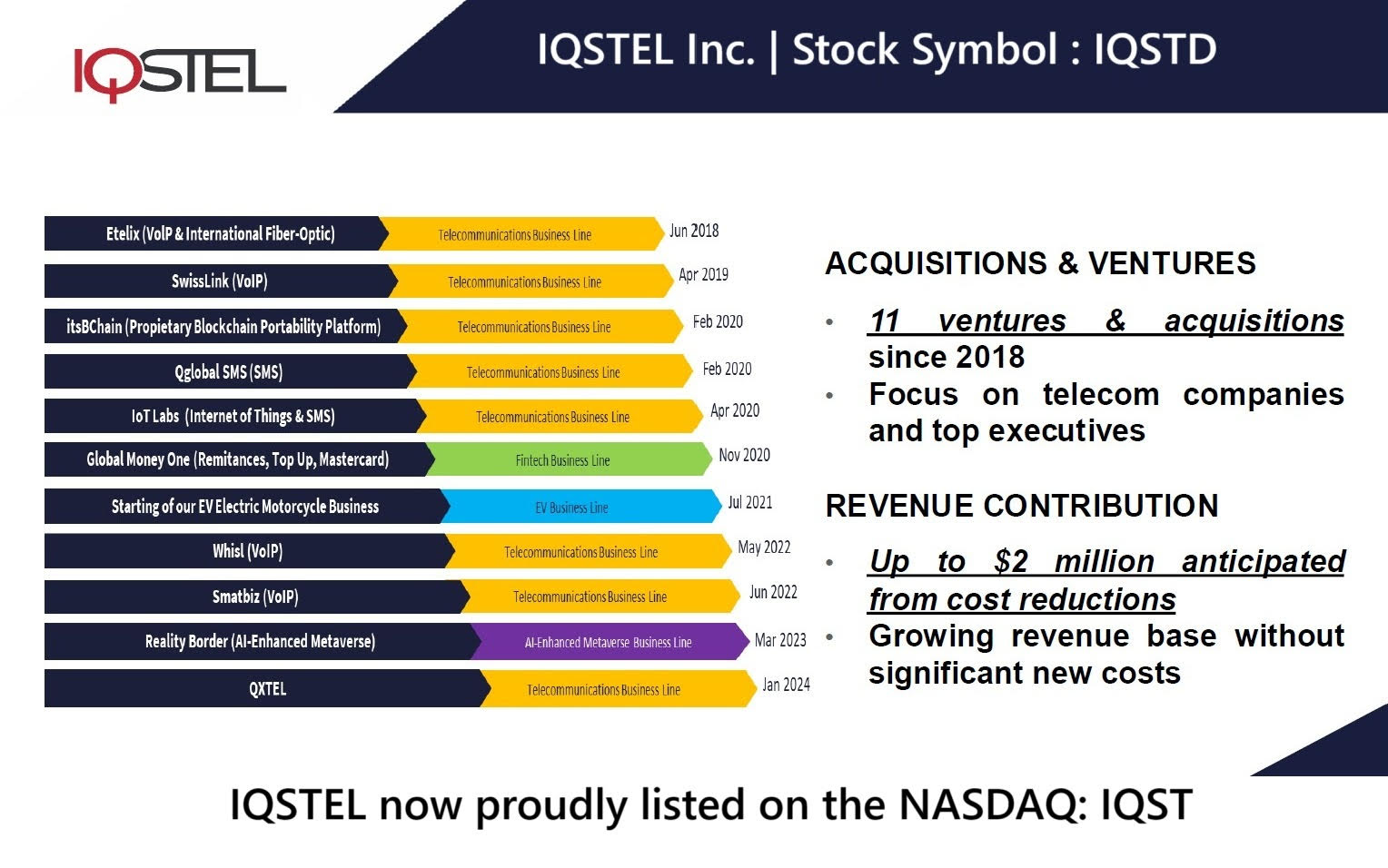

1. Strategic Acquisitions

More on The Californer

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

Recent Highlights Validating the Strategy

Analyst Endorsement and Institutional Interest Rising

More on The Californer

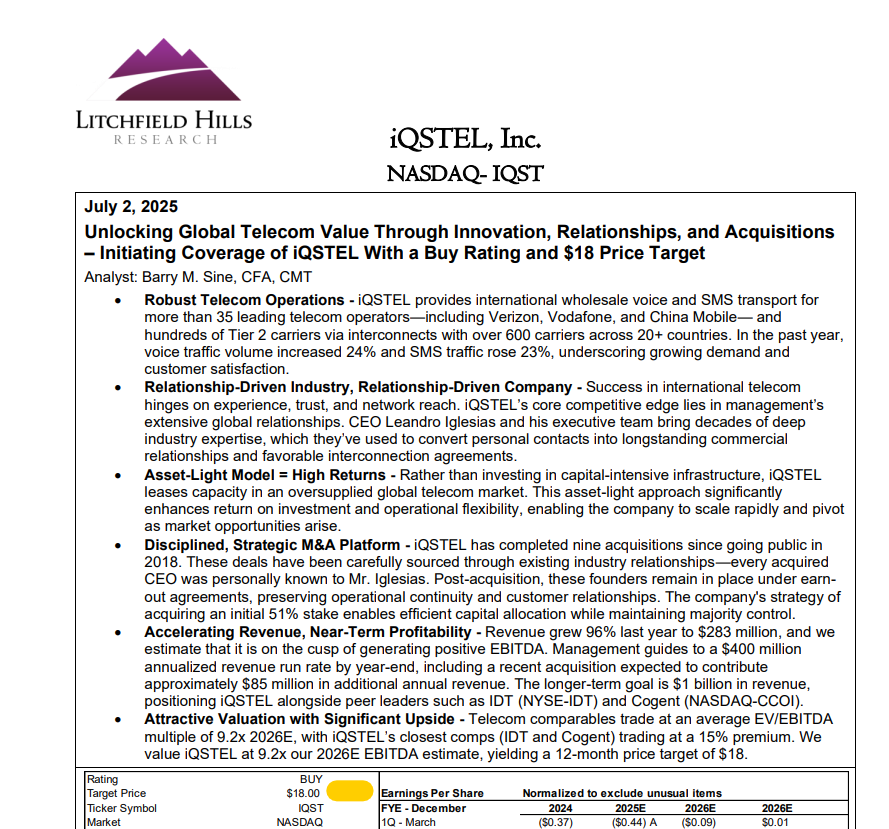

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

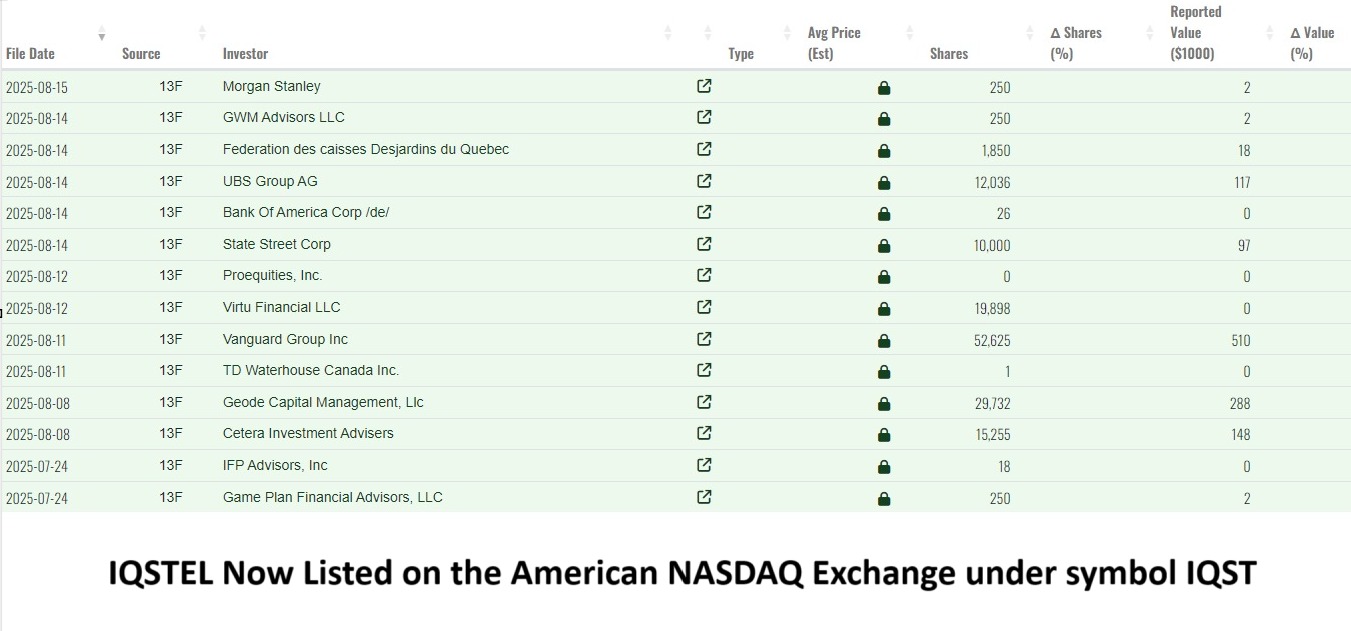

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

With a current $400 million annual revenue run rate, a new $15 million EBITDA run rate plan for 2026, and a bold $1 billion revenue target for 2027, IQST is not just projecting future growth — it's actively engineering it.

IQST by the Numbers: Why Investors Are Paying Attention

- $35M in July revenue alone — puts the company ahead of schedule on its $400M+ run rate

- $17.41 in assets per share, equity per share up to $4.84

- $6.9M in debt eliminated, or nearly $2 per share, strengthening the balance sheet

- Litchfield Hills Research reaffirms $18 price target, citing strong Q2 performance

- New dividend catalyst: IQST shareholders to receive shares in ASII as part of Nasdaq uplisting strategy

Institutions are Buying $IQST:

https://lnkd.in/gqu2dKnY

Strategic Execution: IQST's Roadmap to $1B

On August 25th, IQST unveiled the next phase of its expansion strategy: a $15 million EBITDA run rate goal by 2026 to drive valuation while laying the foundation for $1 billion in revenue by 2027.

This two-pronged "pincer strategy" is built on:

1. Strategic Acquisitions

More on The Californer

- Eastman Craighead Periodontics Expands Professional Education and Collaboration for Dental Teams Across Southwest Florida

- PADT Marks U.S. First as Partnership With Rapid Fusion Brings New Additive Manufacturing Solutions to North America

- Steel Oak Coffee Launches First Interactive Coffee Flavor Wheel for Consumers

- NYC Public School Music Teacher & Singer-Songwriter Craig Klonowski Submits Five Songs for GRAMMY® Consideration

- City Council Candidates Unite Behind "Common Sense Contract with NYC"

IQST is currently vetting 2–3 high-margin acquisition targets — each expected to contribute approximately $5 million in EBITDA. Funding strategies prioritize value-enhancing structures such as preferred equity and commercial bank debt, designed to protect common shareholders while accelerating growth.

2. Operational Streamlining

Across its global divisions, IQST is boosting margins through efficiency initiatives already delivering improved profitability. The telecom segment, for instance, delivered a 30% quarterly jump in net income and $1.1 million in EBITDA in just the first half of 2025.

Strong Momentum Across Key Divisions

IQST's diversified model is more than a buzzword. It's delivering:

- Telecom: $600M+ in historical revenue, strong recurring business, trusted by 600+ operators worldwide

- Fintech: Expansion accelerated by the July 1st acquisition of GlobeTopper, forecasting $34M in H2 revenue and positive EBITDA

- AI: Launch of IQ2Call — an AI-powered, multilingual call center disrupting the $750B global telecom customer service market

- Cybersecurity & Blockchain: Active product development underway to support enterprise and consumer needs globally

Recent Highlights Validating the Strategy

- Q2 2025 Financials (Ended June 30, 2025):

- Gross revenues grew 17% YoY (100% organic growth)

- Gross margin improved by 7.45%

- Net shareholder equity up 20% in 6 months

- Common equity conversions absorbed by the market with no dilution impact

- Equity Exchange and Dividend Partnership with CYCU:

- IQST and CYCU signed an MOU for mutual equity stakes and shareholder dividends in each company — strengthening IQST's shareholder value proposition

Analyst Endorsement and Institutional Interest Rising

More on The Californer

- California High School Football Rankings Shaken Up After a Weekend of Upsets

- Courage Meets Conservation in the Last Horns of Africa on Documentary Showcase

- California partners with Belgium to boost business, strengthen economic ties

- California: Governor Newsom issues legislative update 10.6.25

- California: Governor Newsom signs new laws to help reduce costs for families

Litchfield Hills Research, a respected independent analyst firm, reaffirmed its $18 price target for IQST in August 2025, citing execution strength and financial resilience. Read the full analyst report here: Click to View

Meanwhile, IQST has attracted the attention of 12 institutional investors — building momentum only four months post-Nasdaq uplisting.

Positioned to Become a Billion-Dollar Tech Company

IQST is not in concept mode — it's in growth mode.

With $400M+ in current revenue momentum, a path to $15M EBITDA, an expanding global footprint across 21 countries, and multiple high-growth verticals scaling in parallel, IQST is poised to enter the elite tier of billion-dollar revenue tech firms by 2027.

Whether through strategic acquisitions, AI-driven innovation, or shareholder-enhancing moves like the recent dividend-linked equity exchange, IQSTEL is building real value — and fast.

📈 Investor Takeaway

IQST is executing on every front: revenue growth, margin expansion, shareholder value, and future-proof technology. With its revenue already tracking ahead of plan, and debt reduced to strengthen equity, IQST stands as a compelling play for investors seeking exposure to the converging growth of fintech, AI, telecom, and cybersecurity.

In a sector where EBITDA multiples can range from 10x to 20x, hitting a $15 million EBITDA run rate could imply a valuation of $150M to $300M — well above current levels, with plenty of room to grow toward its $1B goal.

📌 Ticker: $IQST

🌐 Website: www.IQSTEL.com

📧 Investor Relations: investors@iqstel.com

📞 Phone: +1 954-951-8191

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Always conduct your own due diligence. https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on The Californer

- Next Smile+Implant Launches New Website Enhancing Patient Care

- Media Companies and Book Publishing Companies could MAKE MILLIONS with this HALLOWEEN PROMOTION

- Cabrillo Economic Development Corporation Receives Three Awards at SCANPH Homes Within Reach Awards

- Why 5,000 People Are Rethinking Success After This TEDx Talk

- MDRN MUSE Cosmetic Dentistry Unveils New Website

- Birthday Launch the Hutchinson Fund's Earl Sr. and Nina Hutchinson Student Award

- Ford Family Foundation Awards One Circle Foundation Grant to Expand Youth Circles in Rural Oregon and Siskiyou County

- Virginia Doctor Calls for Reform of Physician Non-Competes That Limit Patient Access

- CCHR: Opening State and Private Mental Hospitals Could Fuel Worsening Outcomes

- Geyser Data Appoints Robson Andrade as Chief Revenue Officer to Accelerate Global Sales Growth

- Inspire Medical Staffing Launches New Website to Elevate Emergency Care

- Revenue Optics Lands Former CFO Matt Zimmermann as Executive Advisor — Bringing PE-Backed and Enterprise Rigor to Build the Next Era Growth Platform

- Webinar Announcement: A Genius Shift: Stablecoin Strategy in a New Regulatory Era

- Events by Dubsdread Sets the Table for Unforgettable Weddings, Corporate Events, and Social Gatherings in Winter Park, Florida

- TreasurePulse Launches PQWT-TC Series Water Detector – Precision Groundwater Finder Up to 500M

- FashionSonder Jewellery to Launch "Bright Eyes" Collection on World Sight Day

- California secures court victory, Trump cannot deploy California National Guard into Oregon

- California: Governor Newsom to sue, urges Americans to speak out on Trump's "breathtaking abuse of power" with cross-state Guard deployment

- Family statement on Ike Turner, Jr.'s Passing from Jacquline Bullock

- Revolutionizing Entertainment: Drone Light Shows Take Center Stage at Events and Venues