Trending...

- InventHelp Inventor Develops New Water Dispensing Product for Pets (LOS-325)

- Socket Mobile Announces Second Quarter 2025 Results Release Date and Conference Call

- Sell Your House FAST: New Options Help Homeowners Exit Quickly, Without Repairs or Agents

IQSTEL, Inc. (Stock Symbol: IQST) $IQST Current Plans Include $1 Million Subsidiary Sale with Stock Dividend to Shareholders

CORAL GABLES, Fla. - Californer -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

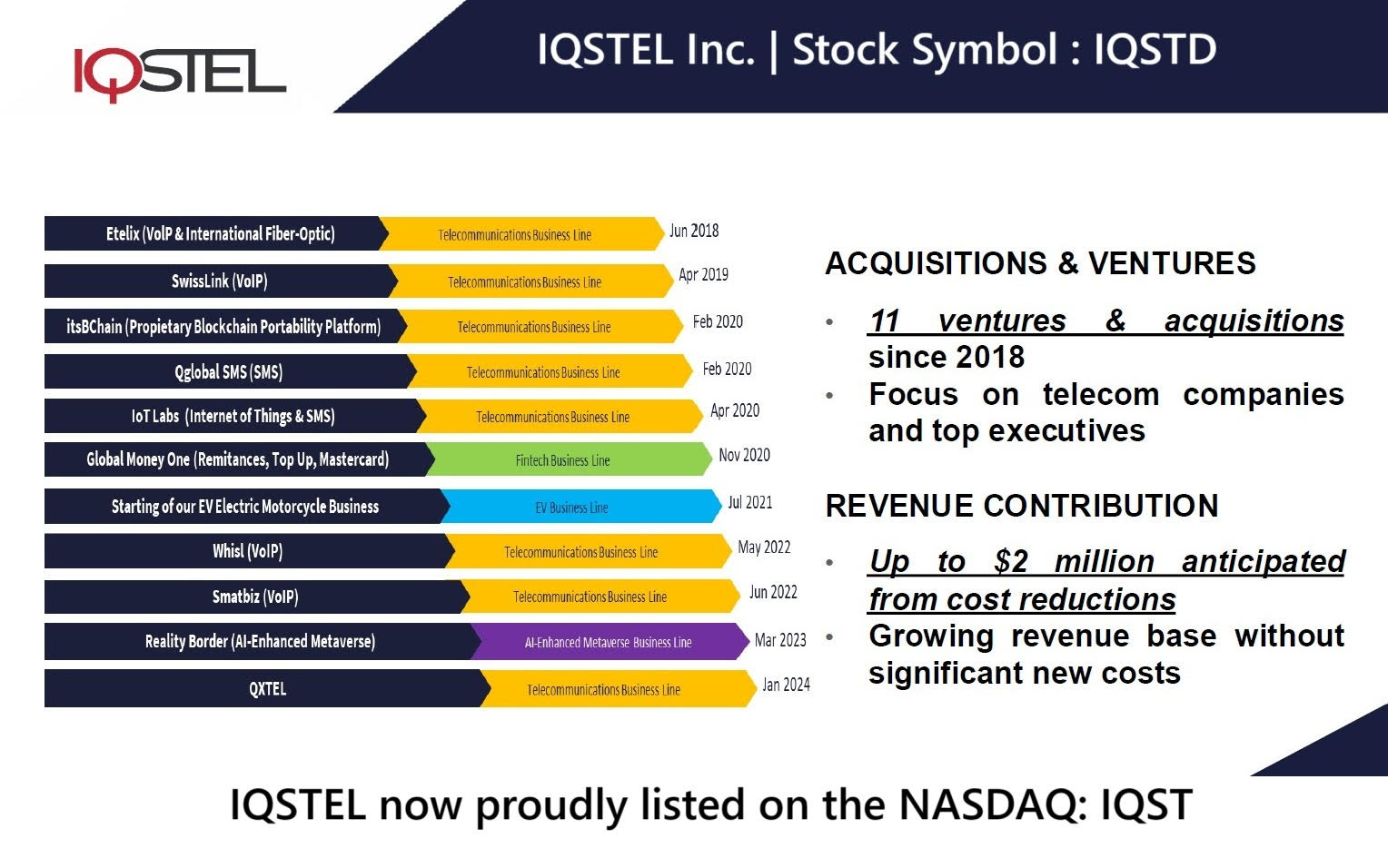

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Accelerating Rollout of Cutting-Edge eSIM and Roaming Connectivity Services.

Preliminary Net Revenue for First Four Months of 2025 Totaled Approximately $77.8 Million.

$57.6M Q1 Revenue Reaffirms Path to $1 Billion by 2027.

$11.6 Million in Stockholders' Equity or $4.38 Per Common Share.

Successful NASDAQ Uplisting with No Capital Raise or Shareholder Dilution.

Definitive Agreement to Acquire 51% of GlobeTopper fintech innovator with operations across America, Europe, and Africa, Effective July 1, 2025.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Preliminary $77.8 Million in Revenue Through April 2025 -- Confirms Full-Year Guidance and Fast-Track to $400M Run Rate

On June 5th IQST announced that its preliminary net revenue for the first four months of 2025 totaled approximately $77.8 million, continuing the company's strong growth momentum and reinforcing its confidence in full-year revenue guidance.

This preliminary figure reflects a 12% increase compared to the same period in 2024, highlighting the strength and consistency of IQST organic growth across its core telecom operations.

IQST operating business anticipates generating over $3 million in adjusted EBITDA in 2025, with positive net income in the seven-digit range, driven by operational efficiencies, scalability, and its increasing focus on high-margin services.

More on The Californer

IQST continues to execute its strategic roadmap to become a $1 billion revenue company by 2027, combining organic growth, targeted acquisitions, and expansion in key technology sectors, including cybersecurity, AI, managed services, and fintech.

The recent IQST uplisting to NASDAQ has already begun to catalyze momentum. The increased visibility and credibility among institutional investors are expected to unlock new strategic opportunities and financial partnerships.

Rapid Global Fintech Expansion with GlobeTopper Acquisition — Fast-Tracking $1 Billion Growth Plan

On May 29th IQST announced the execution of a definitive agreement to acquire 51% of GlobeTopper (GlobeTopper.com) — a dynamic fintech innovator with operations across America, Europe, and Africa. The transaction becomes effective July 1, 2025. GlobeTopper's strong market positioning is evident in its current standalone performance — planning to generate over $65 million in profitable revenue in 2025 alone. Its financial outlook for the next three years reflects steady growth and operational momentum.

The IQST goal is to take GlobeTopper's innovative fintech products and services and scale them globally through IQSTEL's powerful commercial platform — which already reaches over 600 of the largest telecom operators around the world. In parallel, GlobeTopper's existing client base — including prominent multinational brands — opens the door for IQST to expand its reach into new sectors, allowing deeper penetration into the enterprise and global brand markets.

Together, IQST and GlobeTopper plan lead the next wave of convergence between fintech and telecommunications in high-value markets across Africa, Europe, and the Americas. As part of the transaction, Craig Span will continue in his role as CEO of GlobeTopper, ensuring leadership continuity and seamless integration into the IQST Fintech Division.

GlobeTopper will collaborate with GlobalMoneyOne.com, co-developing a 3-year business plan to position itself as a top-tier player in the global fintech ecosystem. The deal puts IQST firmly on track to reach a $400 million revenue run rate and achieve a targeted 80% telecom / 20% tech revenue mix by the end of this year. This acquisition strengthens the IQST position as a high-margin, tech-focused growth platform, advancing its $1 billion revenue goal by 2027. Additionally, IQST plans to invest up to $1.2 million over the next 2 years to accelerate GlobeTopper's growth and product roadmap.

Follow-Up Shareholder Letter Highlighting NASDAQ Benefits, $57.6M Q1 Revenue, and $14.58 Assets Per Share on Path to $1 Billion

On May 20th IQST issued a follow-up shareholder letter to reinforce the strategic value of its recent NASDAQ uplisting and to highlight the company's most important operational and financial metrics.

More on The Californer

IQST has celebrated its official listing on the NASDAQ Capital Market, a transformational milestone that opens the door to unprecedented commercial, financial, and strategic opportunities.

IQST management has now prepared a new Shareholder Letter summarizing the most critical indicators of IQSTEL's financial strength and long-term growth potential.

Key Shareholder Takeaways:

Current Assets Per Share (Q1 2025): $14.58

Current Revenue Per Share: Over $100

Current Stockholders' Equity Per Share (Q1 2025): $4.38

Current Outstanding Shares: 2.9 million

Current Market Cap: 0.10x our Revenue in 2024

Q1 2025 Revenue: $57.6M

2025 Revenue Forecast: $340 million

Year-End Run Rate Goal: $400 million

Year-End Revenue Mix Goal: 80% Telecom / 20% Tech Services

Countries of Commercial Footprint : 21

Employees: 100+

Business Relationships: 600+ global interconnections

Telecom Division (99% revenue stream): Positive Adjusted EBITDA and Positive Net Income

Trading212.com now supports IQST again for European-based investors

IQST Reports $57.6M Q1 Revenue in First NASDAQ Shareholder Letter, Reaffirms Path to $1 Billion by 2027 as Global Tech Evolution Accelerates

On May 15th IQST released its Q1 2025 Shareholder Letter—its first since being uplisted to the NASDAQ Capital Market. In the letter, CEO Leandro Iglesias detailed the company's performance, strategic vision, and transformation into a high-tech multinational on course to reach $1 billion in annual revenue by 2027.

Over the past seven years, IQST has consistently delivered on every major commitment to shareholders including:

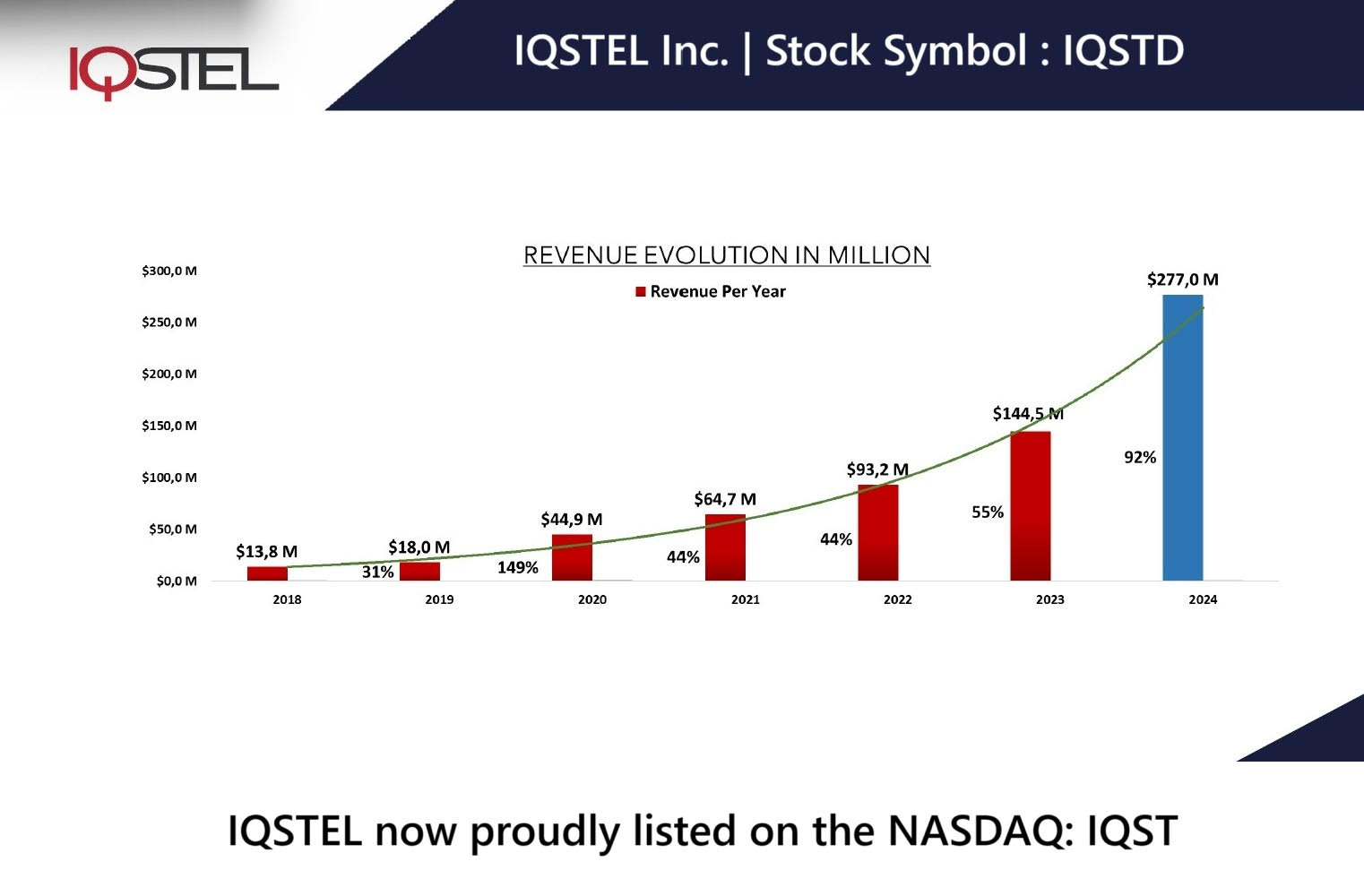

Sustained Revenue Growth: From $13.8 million in 2018 to $283 million in 2024, consistently meeting or exceeding annual forecasts.

Robust Corporate Governance: Fully established Audit, Compensation, and Ethics Committees; an independent Board of Directors; and annual shareholder meetings supporting transparency and accountability.

IQST Uplisting in 2025—with no capital raise or shareholder dilution.

Enhanced Shareholder Value: Revenue Per Share now exceeds $100, reflecting disciplined growth and execution.

Equity Growth: IQST net stockholders' equity improved from ($1.6 million) or -$0.11 per share in 2018 to $11.6 million or $4.38 per common share as of March 31, 2025—a powerful indicator of the value we've created over time.

IQST business has now reached critical mass in terms of infrastructure, scale, and market presence. With over 100 employees operating across more than 20 countries, and 600+ business relationships involving direct network interconnections, IQST has built a platform that is both robust and difficult to replicate.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: IQSTEL, Inc. (Stock Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Accelerating Rollout of Cutting-Edge eSIM and Roaming Connectivity Services.

Preliminary Net Revenue for First Four Months of 2025 Totaled Approximately $77.8 Million.

$57.6M Q1 Revenue Reaffirms Path to $1 Billion by 2027.

$11.6 Million in Stockholders' Equity or $4.38 Per Common Share.

Successful NASDAQ Uplisting with No Capital Raise or Shareholder Dilution.

Definitive Agreement to Acquire 51% of GlobeTopper fintech innovator with operations across America, Europe, and Africa, Effective July 1, 2025.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Preliminary $77.8 Million in Revenue Through April 2025 -- Confirms Full-Year Guidance and Fast-Track to $400M Run Rate

On June 5th IQST announced that its preliminary net revenue for the first four months of 2025 totaled approximately $77.8 million, continuing the company's strong growth momentum and reinforcing its confidence in full-year revenue guidance.

This preliminary figure reflects a 12% increase compared to the same period in 2024, highlighting the strength and consistency of IQST organic growth across its core telecom operations.

IQST operating business anticipates generating over $3 million in adjusted EBITDA in 2025, with positive net income in the seven-digit range, driven by operational efficiencies, scalability, and its increasing focus on high-margin services.

More on The Californer

- California: Governor Newsom strengthens local control in Los Angeles burn scar areas

- California: Governor Newsom signs legislation 7.30.25

- City of Long Beach Announces Departure of Director of Public Works Eric Lopez

- Vision Pay Launches Revolutionary Shopper Mobile App to Transform Web Commerce

- California: Trump tariff policy continues to cause chaos in American economy

IQST continues to execute its strategic roadmap to become a $1 billion revenue company by 2027, combining organic growth, targeted acquisitions, and expansion in key technology sectors, including cybersecurity, AI, managed services, and fintech.

The recent IQST uplisting to NASDAQ has already begun to catalyze momentum. The increased visibility and credibility among institutional investors are expected to unlock new strategic opportunities and financial partnerships.

Rapid Global Fintech Expansion with GlobeTopper Acquisition — Fast-Tracking $1 Billion Growth Plan

On May 29th IQST announced the execution of a definitive agreement to acquire 51% of GlobeTopper (GlobeTopper.com) — a dynamic fintech innovator with operations across America, Europe, and Africa. The transaction becomes effective July 1, 2025. GlobeTopper's strong market positioning is evident in its current standalone performance — planning to generate over $65 million in profitable revenue in 2025 alone. Its financial outlook for the next three years reflects steady growth and operational momentum.

The IQST goal is to take GlobeTopper's innovative fintech products and services and scale them globally through IQSTEL's powerful commercial platform — which already reaches over 600 of the largest telecom operators around the world. In parallel, GlobeTopper's existing client base — including prominent multinational brands — opens the door for IQST to expand its reach into new sectors, allowing deeper penetration into the enterprise and global brand markets.

Together, IQST and GlobeTopper plan lead the next wave of convergence between fintech and telecommunications in high-value markets across Africa, Europe, and the Americas. As part of the transaction, Craig Span will continue in his role as CEO of GlobeTopper, ensuring leadership continuity and seamless integration into the IQST Fintech Division.

GlobeTopper will collaborate with GlobalMoneyOne.com, co-developing a 3-year business plan to position itself as a top-tier player in the global fintech ecosystem. The deal puts IQST firmly on track to reach a $400 million revenue run rate and achieve a targeted 80% telecom / 20% tech revenue mix by the end of this year. This acquisition strengthens the IQST position as a high-margin, tech-focused growth platform, advancing its $1 billion revenue goal by 2027. Additionally, IQST plans to invest up to $1.2 million over the next 2 years to accelerate GlobeTopper's growth and product roadmap.

Follow-Up Shareholder Letter Highlighting NASDAQ Benefits, $57.6M Q1 Revenue, and $14.58 Assets Per Share on Path to $1 Billion

On May 20th IQST issued a follow-up shareholder letter to reinforce the strategic value of its recent NASDAQ uplisting and to highlight the company's most important operational and financial metrics.

More on The Californer

- Free Printable Math Bingo Cards Released for Teachers, Parents, and Students

- Voices for Humanity Sees Hope Spring from the Middle of the World with Catalina Maldonado

- Tsunami Advisory Lifted for Long Beach, Other Southern California Coastal Cities

- Japanese Tradition Meets Hollywood Glitz

- FACTOR Acting School Announces Major Sale on "The Fundamentals of Acting" Course

IQST has celebrated its official listing on the NASDAQ Capital Market, a transformational milestone that opens the door to unprecedented commercial, financial, and strategic opportunities.

IQST management has now prepared a new Shareholder Letter summarizing the most critical indicators of IQSTEL's financial strength and long-term growth potential.

Key Shareholder Takeaways:

Current Assets Per Share (Q1 2025): $14.58

Current Revenue Per Share: Over $100

Current Stockholders' Equity Per Share (Q1 2025): $4.38

Current Outstanding Shares: 2.9 million

Current Market Cap: 0.10x our Revenue in 2024

Q1 2025 Revenue: $57.6M

2025 Revenue Forecast: $340 million

Year-End Run Rate Goal: $400 million

Year-End Revenue Mix Goal: 80% Telecom / 20% Tech Services

Countries of Commercial Footprint : 21

Employees: 100+

Business Relationships: 600+ global interconnections

Telecom Division (99% revenue stream): Positive Adjusted EBITDA and Positive Net Income

Trading212.com now supports IQST again for European-based investors

IQST Reports $57.6M Q1 Revenue in First NASDAQ Shareholder Letter, Reaffirms Path to $1 Billion by 2027 as Global Tech Evolution Accelerates

On May 15th IQST released its Q1 2025 Shareholder Letter—its first since being uplisted to the NASDAQ Capital Market. In the letter, CEO Leandro Iglesias detailed the company's performance, strategic vision, and transformation into a high-tech multinational on course to reach $1 billion in annual revenue by 2027.

Over the past seven years, IQST has consistently delivered on every major commitment to shareholders including:

Sustained Revenue Growth: From $13.8 million in 2018 to $283 million in 2024, consistently meeting or exceeding annual forecasts.

Robust Corporate Governance: Fully established Audit, Compensation, and Ethics Committees; an independent Board of Directors; and annual shareholder meetings supporting transparency and accountability.

IQST Uplisting in 2025—with no capital raise or shareholder dilution.

Enhanced Shareholder Value: Revenue Per Share now exceeds $100, reflecting disciplined growth and execution.

Equity Growth: IQST net stockholders' equity improved from ($1.6 million) or -$0.11 per share in 2018 to $11.6 million or $4.38 per common share as of March 31, 2025—a powerful indicator of the value we've created over time.

IQST business has now reached critical mass in terms of infrastructure, scale, and market presence. With over 100 employees operating across more than 20 countries, and 600+ business relationships involving direct network interconnections, IQST has built a platform that is both robust and difficult to replicate.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: IQSTEL, Inc. (Stock Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on The Californer

- City of Long Beach Advises Residents to Prepare Now Following Tsunami Advisory Issued for California Coast

- World Music Band Ginger Beat Releases New Single and Music Video with 1955 Chevy Bel Air

- California: Governor Newsom announces appointments 7.29.25

- California: Governor Newsom signs legislation 7.29.25

- Meet a Scientologist Designs for Life with Brad Napier

- KIA BRINGS THE FUTURE TO THE HISTORIC KIA FORUM WITH THE "KIA CONNECTED HOME"

- California pre-deploys resources in Plumas, Nevada, and Sierra counties ahead of critical fire weather conditions

- Artbound: "The Cheech" Awarded Two 2025 LA Area EMMY Awards — Honored in ARTS & MUSIC COMPOSITION

- California: Governor Newsom issues emergency proclamation for storm-impacted counties

- Rising Conservative Star Jordan Brace Emerges as Influential Political Voice with Elite Washington Connections

- Conservative Latinos for PA Shaping the Future of Hispanic Community, Guest State Treasurer Stacy Garrity

- California Patriots Organize Newsom Redial Rally 2025 At State Capitol To Address State Leadership Crisis

- White Glove Restoration Earns CIRSX Certification for Medically Important Mold Remediation

- California: Governor Newsom responds to latest Trump sledgehammer to clean air protections

- Long Beach Parks, Recreation and Marine to Offer a Variety of Recreation Classes This Fall

- Chasing Creative Plants Roots in Palm Coast, Builds Marketing Systems for Modern B2B Brands

- Promises kept — new data shows 22,000 arrests and $150 million in recovered stolen goods across California

- InventHelp Inventor Develops Modified Rear Lighting System for Vehicles (SNF-457)

- David M. White, DDS Celebrates 500 Five-Star Reviews in Reno

- Jamal Hill Named Aqua by Delfino Brand Ambassador in LA28 Swim Equity Campaign