Trending...

- New Novel Frail Blood by Edward Stanton Unveils a Haunting Love Story in Post-Dictatorship Argentina - 106

- California: Governor Newsom announces appointments 5.22.25

- DivX Joins Surfrider Foundation to Clean Up San Diego Beaches

Statis Fund Launches AI-Assisted Trading Algorithm, Volatis Strategy, with Y Combinator Graduate Quantbase

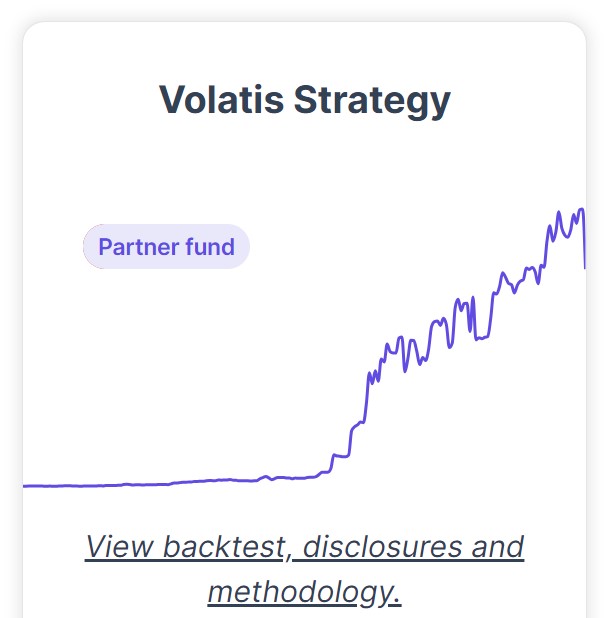

CHICAGO - Californer -- Statis Fund has announced the launch of Volatis Strategy, managed in partnership by Quantbase, an SEC-registered investment advisor and Y Combinator graduate. Volatis Strategy is Statis Fund's most profitable algorithm based on over 10 years of backtesting data and AI assisted statistical analysis.

The Volatis Strategy is engineered with the intent to capture gains from leveraged ETF funds, protect and improve returns during market downturns, and capture returns amid extreme market volatility while significantly improving drawdowns against leveraged ETFs in certain market conditions. The strategy is grounded in over a decade of AI-assisted data analysis along with YTD out-of-sample performance. Statis Fund's and Quantbase's independently validated backtest results exhibited a compelling 10-year Annualized Rate of Return (ARR) of over 73% after fees.

More on The Californer

Early adopter accredited investors receive waived management fees for life with a 20% performance fee until the first million-dollar AUM cut-off. This early adopter incentive underscores the Statis Fund's belief in the potential performance strength the Volatis Strategy presents. Interested parties can now review the strategy on the Quantbase validated strategy page.

Xinyu (Shawn) He, CEO and founder of Statis Fund, remarked, "We have worked closely with Quantbase to launch the Volatis Strategy, with over 10 years of data. The rigorous assessment of our strategy by third parties like Quantbase reflects our dedication to providing investment solutions with strong mathematical fundamentals and investment hypotheses. With our structure we are bringing to market a new model of investment."

The collaboration between Statis Fund and Quantbase aims to set a new standard and rigor in algorithm-based investment strategies leveraging new technologies like AI.

More on The Californer

For more information visit Statis Fund and the Quantbase strategy page.

Media Contact:

Xinyu (Shawn) He

Founder, CEO

shawn@statisfund.com

872-267-1949

Disclosures: Past performance and backtests does not guarantee future performance. Nothing here should be considered an offer, solicitation of an offer, or advice to buy or sell securities. Quantbase Investments, Inc., which, along with its affiliates (including Quantbase, LLC, its affiliated registered investment advisor), is partnered with Statis Fund (the promoter). Statis Fund provides tools and services to the financial industry, and therefore is motivated to act as the promoter to promote certain investments created using Statis Fund's tools or services. Quantbase pays Statis Fund a percentage of fees generated from the performance returns and management fees of the managed assets through their partnership.

The Volatis Strategy is engineered with the intent to capture gains from leveraged ETF funds, protect and improve returns during market downturns, and capture returns amid extreme market volatility while significantly improving drawdowns against leveraged ETFs in certain market conditions. The strategy is grounded in over a decade of AI-assisted data analysis along with YTD out-of-sample performance. Statis Fund's and Quantbase's independently validated backtest results exhibited a compelling 10-year Annualized Rate of Return (ARR) of over 73% after fees.

More on The Californer

- Got a Game Idea? Gamers Home Turns Dreams Into Playable Prototypes in Minutes

- TidewindSportFishing.com Announces New Charter Boat Trips for Brookings Oregon Wild River Fishing Adventurers

- Chosen Launches Mobile Family Closet to Serve Foster, Adoptive, and Kinship Families Across Southeastern Wisconsin

- New Release Explores Grit, Wit, and Appalachian Life in We Saved Ourselves, Kinda

- Napco Security Technologies, Inc. (NSSC) Investors Who Lost Money Have Opportunity to Lead Securities Fraud Lawsuit

Early adopter accredited investors receive waived management fees for life with a 20% performance fee until the first million-dollar AUM cut-off. This early adopter incentive underscores the Statis Fund's belief in the potential performance strength the Volatis Strategy presents. Interested parties can now review the strategy on the Quantbase validated strategy page.

Xinyu (Shawn) He, CEO and founder of Statis Fund, remarked, "We have worked closely with Quantbase to launch the Volatis Strategy, with over 10 years of data. The rigorous assessment of our strategy by third parties like Quantbase reflects our dedication to providing investment solutions with strong mathematical fundamentals and investment hypotheses. With our structure we are bringing to market a new model of investment."

The collaboration between Statis Fund and Quantbase aims to set a new standard and rigor in algorithm-based investment strategies leveraging new technologies like AI.

More on The Californer

- Home Modifications for Seniors

- 14 Bills With Big Discounts for Paying in Full

- WNC Roofing, LLC Opens Spartanburg, SC Location After a Decade of Serving the Upstate

- June Is Men's Health Month 2025:

- Velocity Performance Alliance Shifts Into High Gear with Luxury Auto Real Estate Platform Ahead of NASCAR Debut

For more information visit Statis Fund and the Quantbase strategy page.

Media Contact:

Xinyu (Shawn) He

Founder, CEO

shawn@statisfund.com

872-267-1949

Disclosures: Past performance and backtests does not guarantee future performance. Nothing here should be considered an offer, solicitation of an offer, or advice to buy or sell securities. Quantbase Investments, Inc., which, along with its affiliates (including Quantbase, LLC, its affiliated registered investment advisor), is partnered with Statis Fund (the promoter). Statis Fund provides tools and services to the financial industry, and therefore is motivated to act as the promoter to promote certain investments created using Statis Fund's tools or services. Quantbase pays Statis Fund a percentage of fees generated from the performance returns and management fees of the managed assets through their partnership.

Source: Statis Fund, LLC

0 Comments

Latest on The Californer

- Vision Pay Launches Revolutionary Shopper Mobile App to Transform Values-Based Commerce

- Grid Titans earns BBB® Accreditation

- Introducing Grid Titans: A New Force in Solar Focused on Energy Education and Independence

- Ventura County Public Health, VC-ASH, and Tobacco Cessation Programs Mark World No Tobacco Day 2025

- New Website Launch Positions TekTone Builders As Tulsa's Commercial Construction Leader

- Inframark Expands Its Capabilities and Presence in Arizona, Adding Wastewater Experts Mehall Contracting

- FilmHedge Is Letting A.I. Into the Deal Room—And Hollywood Will Never Be the Same

- Chapter 7: A LETTER TO PAWTONE-- intimate, transformative moments

- Careful Security Launches "StackMap" to Helping SMB's Cut 10% of Their Security Software

- TWO ERVIN COHEN & JESSUP PARTNERS NAMED 'WOMEN OF INFLUENCE' BY LOS ANGELES BUSINESS JOURNAL

- Healthy Hair Bar Founder Rochelle Chappelle Returns to KJLH Women's Expo with Complimentary Microscope Hair & Scalp Analysis

- Community Colleges of Ventura County Honor over 6,000 Graduates at 2025 Commencement

- This Artificial Intelligence Platform Could Change How Hollywood Gets Funded Forever

- The Thrift Shop at the Heart of Community Impact Gets a New Name

- Long Beach: Annual KJLH Women's Health Expo Celebrates 25 Years of Women's Wellness

- $100 Million Financing Unlocked for Aggressive Acquisition and Growth Strategy Including Plan to Acquire Remote Lottery Platform: Stock Symbol: LTRY

- New Novel @UGMAN Exposes the Emotional Toll of Social Media

- WWE® AND SEAGRAM'S ESCAPES SPIKED™ LAUNCH FIRST-EVER CO-BRANDED PRODUCT

- ARCH Dental + Aesthetics Unveils New Website for Enhanced Patient Experience

- GHB Intellect Announces Sponsorship of IPBC Global 2025 in Boston